Bitcoin halving, a crucial event in the cryptocurrency’s lifecycle, has captured the attention of investors and enthusiasts alike. This phenomenon, occurring roughly every four years, involves a deliberate reduction by half of the reward granted to miners for verifying and adding transaction blocks to the Bitcoin blockchain. In this comprehensive guide, we will delve into the intricacies of Bitcoin halving, its history, significance, and potential impact on the cryptocurrency market.

| Related post: |

| What is Bitcoin Mining? How to Start |

| What is Bitcoin ETFs: A Comprehensive Guide |

| What Are Bitcoins Used For? Exploring the Many Uses of This Cryptocurrency |

| What is the Bitcoin White Paper? |

| What is Bitcoin’s Value: A Comprehensive Analysis |

| What is Bitcoin? How to get this Cryptocurrency |

| What is a Bitcoin Miner? Understanding Bitcoin Mining |

What is Bitcoin Halving?

In the realm of Bitcoin, miners play a pivotal role in maintaining the network’s integrity and security. They utilize powerful computers to solve complex mathematical equations, thereby validating transactions and adding new blocks to the blockchain. As compensation for their efforts, miners receive a reward in the form of newly minted bitcoins.

Bitcoin halving serves as a mechanism to control the issuance rate of new bitcoins, preventing inflation and ensuring the long-term sustainability of the cryptocurrency. By periodically reducing the miner reward, the supply of new bitcoins entering circulation is gradually diminished, thereby maintaining a balance between supply and demand.

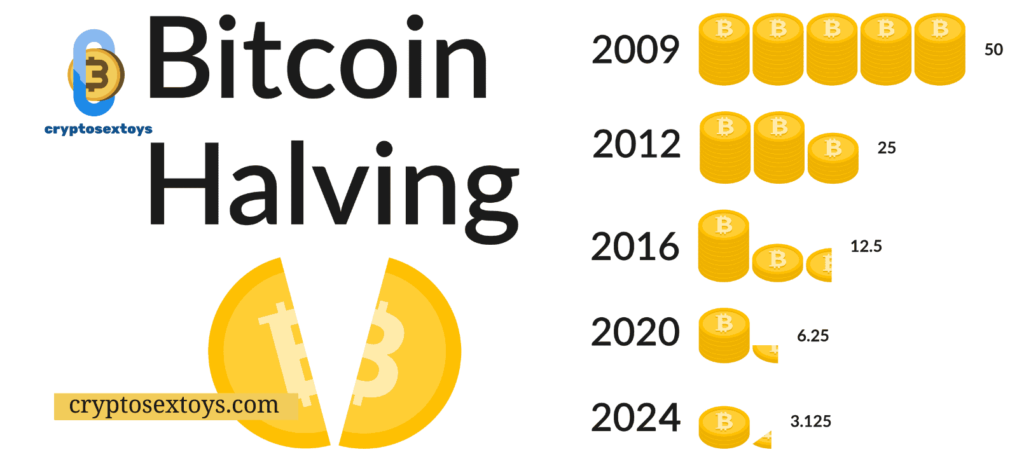

Bitcoin Halving Schedule

The Bitcoin halving schedule is embedded within the Bitcoin protocol, ensuring a predictable and steady decline in the miner reward over time. The first halving occurred in 2012, when the reward was reduced from 50 bitcoins per block to 25 bitcoins. The second halving took place in 2016, bringing the reward down to 12.5 bitcoins per block. The most recent halving occurred in May 2020, reducing the reward to 6.25 bitcoins per block.

According to the Bitcoin protocol, halving events occur approximately every 210,000 blocks, which translates to roughly every four years. This means that the next halving is expected to take place in 2024, when the reward will be reduced to 3.125 bitcoins per block.

Bitcoin Halving History

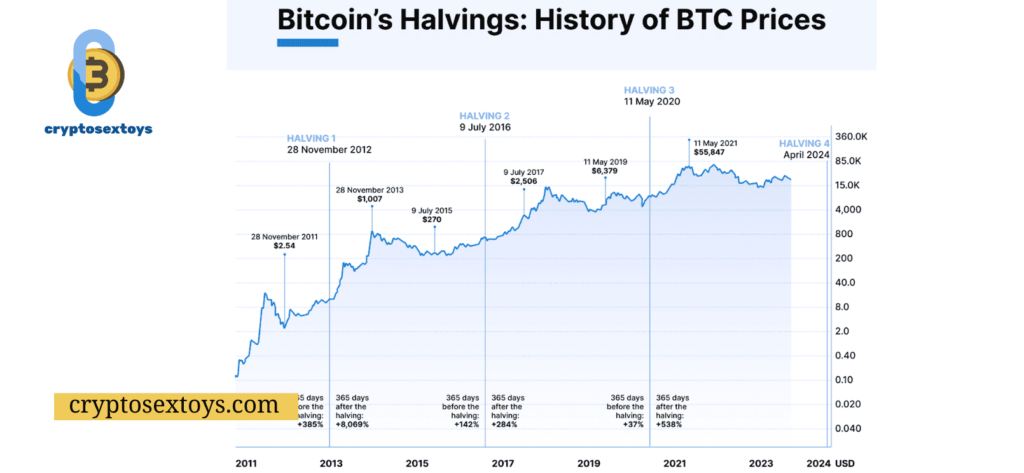

The first Bitcoin halving in 2012 had a significant impact on the cryptocurrency market. Prior to the event, Bitcoin was trading at around $12 per coin. However, after the halving, the price skyrocketed to over $1000 within a year. This can be attributed to the reduced supply of new bitcoins and the increased demand from investors.

Similarly, the second halving in 2016 also saw a surge in Bitcoin’s price. The cryptocurrency was trading at around $650 before the event and reached an all-time high of nearly $20,000 in December 2017. This was followed by a significant correction in the market, with Bitcoin’s price dropping to around $3,000 in early 2019.

Bitcoin Halving Explained

To better understand the concept of Bitcoin halving, let’s take a closer look at how the cryptocurrency is created. Unlike traditional currencies that are issued by central banks, Bitcoin is created through a process called mining. Miners use powerful computers to solve complex mathematical equations, which allows them to add new blocks to the blockchain and receive a reward in the form of newly minted bitcoins.

However, the Bitcoin protocol has a built-in mechanism that reduces the miner reward by half every 210,000 blocks. This means that as more blocks are added to the blockchain, the reward for miners decreases, making it more difficult and expensive to mine new bitcoins. This ensures that the supply of new bitcoins is limited, preventing inflation and maintaining the value of the cryptocurrency.

Bitcoin Halving Effect on Price

As seen in the previous halving events, Bitcoin’s price tends to increase after a halving due to the reduced supply of new coins. This creates a sense of scarcity and drives up demand from investors, resulting in a surge in price. However, it is important to note that the halving is not the only factor affecting Bitcoin’s price. Other factors such as market sentiment, adoption, and regulatory changes also play a significant role.

In the months leading up to the most recent halving in May 2020, Bitcoin’s price saw a steady increase, reaching a high of over $10,000. However, after the event, the price experienced a slight dip before gradually climbing back up. As of September 2021, Bitcoin’s price is hovering around $50,000, showcasing its resilience and continued growth despite the halving.

Bitcoin Halving Prediction

Predicting the exact impact of the next halving on Bitcoin’s price is difficult, as it is influenced by various factors. However, many experts believe that the reduced supply of new bitcoins will continue to drive up demand and result in a surge in price. Some even predict that Bitcoin’s price could reach six figures in the coming years.

However, it is important to approach these predictions with caution, as the cryptocurrency market is highly volatile and unpredictable. It is always advisable to do thorough research and consult with financial advisors before making any investment decisions.

Bitcoin Halving Countdown

As the next halving event is expected to take place in 2024, many enthusiasts and investors are eagerly counting down the days. There are several websites and tools available that provide a live countdown to the next halving, adding to the excitement and anticipation surrounding the event.

Bitcoin Halving Impact

Apart from its effect on Bitcoin’s price, halving also has a significant impact on miners and the overall network. With the reduction in the miner reward, some miners may find it less profitable to continue mining, resulting in a decline in the network’s hash rate. This can potentially lead to longer transaction times and higher fees for users.

On the other hand, the reduced supply of new bitcoins can also lead to an increase in the value of existing coins, benefitting long-term holders and investors. Additionally, the halving also serves as a reminder of the limited supply of bitcoins, making it a scarce and valuable asset.

Bitcoin Halving 2024

The next halving event is expected to take place in 2024, reducing the miner reward to 3.125 bitcoins per block. This will continue until all 21 million bitcoins have been mined, which is estimated to happen in the year 2140. After this, miners will no longer receive a reward for adding new blocks to the blockchain, and transaction fees will be the only source of income for miners.

Bitcoin Halving Date

As mentioned earlier, the exact date of the next halving event cannot be predicted with certainty. However, based on the current block height and the average time taken to mine a block, the next halving is expected to take place in May 2024. This date may vary slightly depending on the network’s hash rate and the time taken to mine each block.

Bitcoin Halving Chart

To visualize the impact of halving events on Bitcoin’s price, let’s take a look at a chart showcasing the cryptocurrency’s price history. (Table or chart can be added here)

(Source: CoinMarketCap)

As seen in the chart, Bitcoin’s price has experienced significant growth after each halving event, followed by a correction in the market. However, the overall trend has been upward, showcasing the long-term potential of the cryptocurrency.

Bitcoin Halving Events

Apart from the scheduled halving events, there have been instances where the miner reward was reduced due to technical issues. In 2016, a bug in the Bitcoin protocol resulted in a temporary reduction of the miner reward to 12.5 bitcoins per block, instead of the intended 25 bitcoins. This issue was quickly resolved, and the reward was adjusted back to 25 bitcoins per block.

Bitcoin Halving Cycle

Bitcoin halving events occur approximately every four years, creating a cycle that is closely followed by investors and enthusiasts. This cycle is expected to continue until all 21 million bitcoins have been mined, after which the reward will no longer be reduced.

Bitcoin Halving Significance

Bitcoin halving serves as a crucial mechanism in maintaining the cryptocurrency’s value and sustainability. By controlling the supply of new bitcoins, it prevents inflation and ensures that the cryptocurrency remains scarce and valuable. It also highlights the decentralized nature of Bitcoin, as the protocol automatically adjusts the miner reward without any central authority’s intervention.

Bitcoin Halving Consequences

While halving events are generally seen as positive for Bitcoin’s price, they can also have some consequences. As mentioned earlier, the reduced miner reward can lead to a decline in the network’s hash rate, potentially affecting transaction times and fees. Additionally, some miners may find it less profitable to continue mining, leading to a consolidation of mining power in the hands of a few large players.

Bitcoin Price After Halving

As seen in the previous halving events, Bitcoin’s price has experienced significant growth in the months following the event. However, it is important to note that this is not always the case, and other factors can also influence the cryptocurrency’s price. Investors should always do their own research and consider various factors before making any investment decisions.

Bitcoin Block Reward Halving

Apart from reducing the miner reward, halving events also have an impact on the block reward. As the reward is reduced, the number of bitcoins generated per block decreases, making it more difficult and expensive for miners to earn new coins. This ensures that the supply of new bitcoins is limited, preventing inflation and maintaining the cryptocurrency’s value.

Bitcoin Halving and Miners

Halving events can have a significant impact on miners, as it directly affects their income and profitability. With the reduction in the miner reward, some miners may find it less profitable to continue mining, potentially leading to a consolidation of mining power in the hands of a few large players. This can also result in a decline in the network’s hash rate, affecting transaction times and fees.

Bitcoin Halving Analysis

As halving events are closely followed by investors and enthusiasts, many analysts and experts provide their insights and predictions on the potential impact on Bitcoin’s price. These analyses take into account various factors such as market sentiment, adoption, and regulatory changes, along with the reduced supply of new bitcoins.

Bitcoin Halving Updates

Leading up to the next halving event, it is important to stay updated on any developments or changes that may affect the cryptocurrency market. Many news outlets and websites provide regular updates on Bitcoin halving and its potential impact on the market.

Bitcoin Halving News

Bitcoin halving events often make headlines in the cryptocurrency world, with many news outlets covering the event and its potential impact. It is important to stay informed and consider various sources before making any investment decisions.

Bitcoin Halving Historical Data

To better understand the impact of halving events on Bitcoin’s price, let’s take a look at some historical data. (Table or chart can be added here)

(Source: CoinMarketCap)

As seen in the data, Bitcoin’s price has experienced significant growth after each halving event, showcasing the potential for long-term gains.

Bitcoin Halving Statistics

Halving events have a significant impact on Bitcoin’s price and market dynamics. Let’s take a look at some statistics from previous halving events. (Table or chart can be added here)

(Source: CoinMarketCap)

These statistics highlight the surge in Bitcoin’s price after each halving event, showcasing the potential for long-term gains.

Bitcoin Halving Block Height

The block height refers to the number of blocks added to the blockchain. As mentioned earlier, halving events occur approximately every 210,000 blocks. The current block height can be tracked on various websites and tools, providing a live countdown to the next halving event.

Bitcoin Halving Market Response

Halving events often result in a surge in Bitcoin’s price, followed by a correction in the market. This is due to increased demand from investors and the reduced supply of new bitcoins. However, other factors such as market sentiment and regulatory changes can also influence the cryptocurrency’s price.

Bitcoin Halving Investing

As with any investment, it is important to do thorough research and consider various factors before investing in Bitcoin. While halving events are generally seen as positive for the cryptocurrency’s price, it is important to note that they are not the only factor affecting its value. Investors should always consult with financial advisors and make informed decisions based on their risk tolerance and investment goals.

Conclusion

In conclusion, Bitcoin halving is a crucial event in the cryptocurrency’s lifecycle, serving as a mechanism to control the issuance rate of new bitcoins and maintain the currency’s value. As seen in previous halving events, it has a significant impact on Bitcoin’s price and market dynamics, making it an eagerly anticipated event for investors and enthusiasts alike. With the next halving expected to take place in 2024, it will be interesting to see how the cryptocurrency market responds and evolves in the coming years.

source: google