What Is a DEX? A Decentralized Exchange (DEX) transforms the cryptocurrency transaction experience, connecting buyers and sellers in a peer-to-peer (P2P) marketplace. Unlike Centralized Exchanges (CEXs), DEXs operate on a non-custodial model, ensuring users retain control over their private keys throughout transactions.

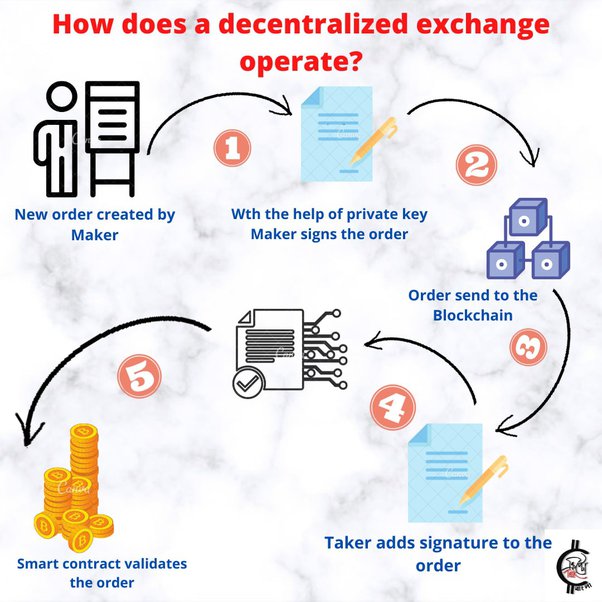

DEXs, devoid of central authorities, rely on smart contracts for trustless and secure transactions. These self-executing contracts follow predefined conditions, recording each interaction on the blockchain. This innovative approach represents a rapidly growing segment in the digital asset market, introducing new financial products and reshaping the landscape of cryptocurrency trading.

| Next Up In Investing |

| What is a Cryptocurrency Exchange? |

| What is USDT? How to Buy |

| What is USDC? How to Buy |

| What Is a CEX? Centralized Exchanges Explained |

What are decentralized exchanges?

Decentralized exchanges (DEXs) revolutionize cryptocurrency trading by facilitating direct transactions through smart contracts, eliminating the need for intermediaries. In contrast, centralized exchanges (CEXs), often operated by entities like banks, dominate trading volume due to regulatory compliance and user-friendly interfaces.

CEXs act as secure custodians of users’ funds, akin to traditional banks, making them popular among newcomers. On the other hand, DEXs empower users to trade directly from their wallets, enhancing autonomy but requiring responsible management of private keys.

In the decentralized landscape, funds take the form of “I owe you” (IOU) tokens, freely tradable on the network. Notably, popular DEXs are built on leading blockchains, with Ethereum being a key player.

Decentralized vs. Centralized Exchanges: A Quick Comparison

| Aspect | Decentralized Exchanges (DEX) | Centralized Exchanges (CEX) |

| Trading Mechanism | Direct user-to-user via smart contracts | Intermediated trading by the exchange |

| Fund Custody | Users control funds directly | Custodied by the exchange with added security |

| Platform Ease | Learning curve for autonomy | User-friendly, ideal for newcomers |

| Popular Blockchain | Built on blockchains with smart contract support | Operated on the blockchain or layer-one protocols |

In essence, DEXs offer direct, autonomous trading, while CEXs provide familiarity and security, catering to the diverse needs within the cryptocurrency trading ecosystem.

How do DEXs work?

Decentralized exchanges (DEXs) operate on blockchain networks supporting smart contracts, offering users direct custody of their funds. Each trade on a DEX incurs transaction and trading fees, and there are three main types: Automated Market Makers (AMMs), Order Book DEXs, and DEX Aggregators.

1. Automated Market Makers (AMMs):

AMMs address liquidity challenges by using smart contracts to set asset prices through blockchain oracles. Instead of traditional order matching, AMMs utilize liquidity pools funded by users. These liquidity providers earn transaction fees but face risks like impermanent loss. DEXs are ranked by Total Value Locked (TVL), and insufficient liquidity can result in slippage.

2. Order Book DEXs:

Order Book DEXs compile buy and sell orders for specific asset pairs. Two types exist: on-chain and off-chain order books. On-chain DEXs maintain order information on the blockchain, allowing leverage but often suffering from liquidity issues. Off-chain DEXs settle trades on the blockchain, offering leveraged trading and fund lending options. Liquidity challenges persist, and smart contract-related risks emerge.

3. DEX Aggregators:

DEX aggregators tackle liquidity issues by combining multiple protocols to minimize slippage on large orders and optimize swap fees. They source liquidity from various DEXs and, in some cases, centralized platforms, providing users with an enhanced trading experience while remaining non-custodial.

In summary, DEXs offer diverse trading mechanisms, each with its advantages and challenges. Users must weigh factors such as liquidity, slippage, and smart contract risks when navigating the evolving landscape of decentralized exchanges.

How to use decentralized exchanges

Utilizing decentralized exchanges (DEXs) is a hassle-free process, eliminating sign-up requirements. Users only need a wallet compatible with the specific smart contracts on their chosen network. This user-friendly approach ensures accessibility for anyone with a smartphone and an internet connection.

Here’s a brief guide:

- Choose Your Network: Decide on the network, considering transaction fees associated with each trade.

- Select a Wallet: Choose a wallet compatible with the selected network and fund it with the native token for transaction fees.

- Use Wallet Extensions: Easily added to browsers, wallet extensions streamline interaction with DEXs. Import existing wallets or create new ones for added security.

- Mobile Accessibility: Wallets often have mobile applications, enabling on-the-go access to DeFi protocols with built-in browsers for smart contract interactions.

- Fund Your Wallet: Purchase tokens (e.g., ETH for Ethereum) on centralized exchanges and withdraw them to your user-controlled wallet.

- Connect to DEXs: Respond to a pop-up prompt or click the “Connect Wallet” button on the DEX website for seamless interaction.

In essence, DEXs offer financial inclusivity through a simple and secure user experience.

Advantages of using a DEX

Trading on decentralized exchanges (DEXs), while potentially costlier during high network transaction fees, offers substantial benefits:

- Token Availability:

- DEXs provide a broader range of tokens compared to centralized exchanges.

- Early access to projects is possible, but caution is needed to avoid scams like “rug pulls.”

- Anonymity:

- User anonymity is maintained on DEXs.

- No need for the standard identification process (KYC) required by centralized exchanges.

- Reduced Security Risks:

- Users who control their funds experience lower hacking risks.

- DEXs don’t control user funds, minimizing exposure in the event of a hack.

- Reduced Counterparty Risk:

- Smart contracts on DEXs eliminate counterparty risk.

- Transactions are conducted without intermediaries, ensuring contractual obligations are met.

To enhance safety, users can verify the audit status of DEX smart contracts through a quick web search and consider the experiences of other traders when making informed decisions.

Disadvantages of using DEXs

While decentralized exchanges (DEXs) offer significant advantages, there are notable drawbacks, including:

- Specific Knowledge Requirements:

- Using DEXs necessitates understanding cryptocurrency wallets and smart contract interactions.

- Users must fund wallets with the correct tokens, and slippage adjustments can be complex, posing challenges, especially for less experienced traders.

- Errors like withdrawing to the wrong network, overpaying fees, or falling victim to impermanent loss are common without the necessary knowledge.

- Smart Contract Vulnerabilities:

- Although smart contracts undergo audits, human errors can lead to exploitable bugs slipping through.

- Unforeseen exploits can jeopardize liquidity providers’ tokens despite reputable audits.

- Unvetted Token Listings:

- DEXs allow anyone to list tokens, making investors susceptible to scams like rug pulls.

- Verification mechanisms, while present, may require specific knowledge, creating a barrier for some users.

To mitigate risks, traders are encouraged to conduct due diligence, including reading token whitepapers, engaging with social media communities, and seeking audits. This proactive approach helps safeguard against common scams and malicious activities on DEXs.

Decentralized exchanges keep evolving

Since their emergence in 2014, decentralized exchanges (DEXs) have undergone significant evolution. Initially, DEXs faced challenges with liquidity, but the advent of Automated Market Maker (AMM) technology addressed these issues, leading to a surge in popularity.

Enforcing Know Your Customer (KYC) and Anti-Money Laundering (AML) checks on DEXs proves challenging due to the absence of a central entity for traditional verification. Despite this, regulators may seek to implement such checks on decentralized platforms.

Unlike custodians subject to regulations, DEXs that accept user deposits require blockchain-signed messages for fund movements, exempting them from certain regulations.

Modern decentralized exchanges offer diverse functionalities, allowing users to borrow funds for leveraging positions, lend funds for passive interest earnings, and provide liquidity to earn trading fees. The evolving landscape of DEXs reflects the growing influence of blockchain-based financial services and innovative technologies.

Conclusion – What Is a DEX?

In summary, decentralized exchanges (DEXs) offer a versatile and evolving landscape for cryptocurrency users. Accessible through web interfaces, desktop applications, or mobile apps like Uniswap and SushiSwap, DEXs primarily support cryptocurrency pairs, requiring separate channels for fiat trading.

DEX usage involves fees for trading, smart contract interactions, withdrawals, and blockchain transactions, varying by platform. Looking forward, DEXs are poised for growth, with improvements in user interfaces and features, reinforcing their integral role in the cryptocurrency ecosystem.

F&Q

1. How do I access a DEX?

Your gateway to a decentralized exchange (DEX) is flexible—choose from a web interface, desktop application, or mobile app, depending on the specific DEX platform. Notable DEXs like Uniswap, SushiSwap, PancakeSwap, each present their unique interfaces and functionalities.

2. Can I trade fiat currency on a DEX?

DEXs predominantly facilitate cryptocurrency-to-cryptocurrency trades. For fiat transactions, the usual route involves utilizing centralized exchanges or peer-to-peer platforms to convert fiat to cryptocurrency before engaging with a DEX.

3. Are there fees associated with using DEXs?

Indeed, using DEXs comes with fees covering various aspects—trading, smart contract interactions, withdrawals, and gas fees (blockchain transaction costs). Fee structures are platform-specific, introducing diversity in the overall cost of transactions.

4. What’s the future of DEXs?

DEXs have witnessed substantial popularity and are poised for ongoing evolution. Anticipate enhancements in user interfaces, feature expansions, and broader adoption of blockchain technology, positioning DEXs as indispensable components within the cryptocurrency ecosystem.

More infor: https://rdi.berkeley.edu/berkeley-defi/assets/material/Updated%20Lecture%205%20Slides.pdf