In the realm of cryptocurrency investments in India, the burning question on many minds is, “How to buy cryptocurrency in India?” Despite the absence of clear regulatory guidelines, a staggering 20,000% surge in the past year has propelled investments from $200 million to an impressive $40 billion. Numerous investors have seized the opportunity presented by this unprecedented growth.

If you’re eager to join their ranks, this concise yet comprehensive guide is your roadmap to exploring the dynamic landscape of cryptocurrency investments in India. From understanding the diverse range of cryptocurrencies to selecting a secure platform, each step demands careful consideration in this uncharted financial frontier.

Invest in Cryptocurrency in India

In the landscape of cryptocurrency investments in India, the question resonates: “How to buy cryptocurrency in India?” Despite the government’s debatable stance on crypto assets, the market is witnessing a surge, driven by innovative startups like WazirX introducing concepts such as Non-Fungible Tokens (NFTs). Let’s delve into the factors fueling this uptick and the rise of crypto exchanges in the country.

Factors Behind the Crypto Boom:

- Entrepreneurial Vision in the Face of Economic Challenges:

India’s high inflation rates and cumbersome investment avenues paved the way for visionary entrepreneurs to establish cryptocurrency exchanges. Notably, entrepreneurs like Nischal Shetty seized this opportunity, creating exchanges with user-friendly interfaces, minimal annual maintenance charges, and lower trading fees. - 24×7 Accessibility and Potential Returns:

The intrinsic nature of crypto and blockchain technology enables these exchanges to operate 24×7, offering a streamlined and potentially lucrative investment avenue for individuals. This shift from traditional assets to cryptocurrency investments marks a paradigm change in the investment landscape.

The Most Favoured Cryptocurrencies:

In the crypto realm, Bitcoin (BTC) stands as the OG token, boasting the highest market cap at USD 598 billion. However, there’s a growing sentiment that Ether (ETH), the native token of the Ethereum network, could potentially surpass Bitcoin in the future.

Other notable cryptocurrencies gaining popularity include:

- Polygon (MATIC)

- Litecoin (LTC)

- Binance Coin (BNB)

- Polkadot (DOT)

- Cardano (ADA)

- Solana (SOL)

The market caps of these cryptocurrencies range from USD 5.6 billion to USD 48 billion, presenting diverse investment opportunities for enthusiasts.

How to Buy Bitcoin in India in 4 Steps Legally?

Delving into the world of cryptocurrency can be an exciting venture, especially when considering the most renowned digital currency—Bitcoin. If you’re wondering, “How to buy cryptocurrency in India?” you’re in the right place. Let’s walk through the essential steps to acquire Bitcoin seamlessly.

Step 1 Selecting the Right Crypto Exchange

To kick off your Bitcoin investment journey, you’ll need to choose a reliable crypto exchange. For beginners, it’s recommended to opt for an exchange that combines user-friendliness with low fees and robust security. Notable platforms like Unocoin, WazirX, ZebPay, and CoinDCX make excellent choices. If you already have a specific exchange in mind, ensure it aligns with your preferences.

Step 2 Choosing a Payment Option:

Once you’ve selected an exchange, funding your account becomes the next crucial step. Different exchanges offer various funding options, including bank transfers, net banking, Mobikwik, cryptocurrency wallets, or UPI. Keep in mind that transaction fees may vary based on the funding method. Electronic transfers from a bank account typically make the most financial sense, given their lower associated fees.

Step 3 Placing Your First Order:

With a funded account, you’re ready to make your first Bitcoin purchase. The process varies depending on the platform, but generally, you’ll either tap a button or input Bitcoin’s ticker symbol (BTC) and the desired investment amount. Understand that due to Bitcoin’s current high value, even a modest investment grants you a percentage ownership of a Bitcoin.

Step 4 Securing Your Investment:

After acquiring Bitcoin, the final step involves deciding on a safe storage option. Most crypto exchanges provide integrated Bitcoin wallets or recommend trusted partners for secure storage. While exchanges often use offline cold storage for added security, some users prefer the extra precaution of personal wallets, either online or offline. Note that transferring crypto off an exchange may incur a small withdrawal fee, and losing the private key to your third-party wallet custodian could result in permanent loss of access.

Where to buy it?

To purchase Bitcoin in India, choose a reliable platform such as Coindesk, ZebPay, or Coinbase. These exchanges offer seamless transactions at current market rates, with the option to use international credit cards.

For added convenience, consider using downloadable mobile applications provided by some exchanges, compatible with Android and iOS. This facilitates quick and secure transactions linked directly to your bank account.

Before venturing into Bitcoin trading, undergo a basic KYC process, ensuring compliance by linking your PAN card to the cryptocurrency exchange account. In India, a PAN card is a prerequisite for Bitcoin transactions, and it must be connected to the designated bank accounts.

Lastly, be aware of the minimum investment required for Bitcoin transactions to make informed decisions aligned with your financial goals. These streamlined steps empower Indian investors to navigate the cryptocurrency landscape efficiently while adhering to regulatory standards.

How to buy cryptocurrency on Binance India

For millions of Indian investors, Binance stands out as the largest global cryptocurrency exchange, offering seamless P2P trading. Here, we’ll walk you through the step-by-step process of acquiring your first crypto asset on Binance.

Step-by-Step Guide:

Step 1 Access P2P Trading:

- Begin by navigating to the Buy Crypto section on the Binance home page and select P2P Trading from the dropdown menu. It’s important to note that the third-party payment option for WazirX is currently disabled, and Simplex may not be the most reliable choice for Indian credit cards.

Step 2 Select Cryptocurrency and Payment Method:

- Choose your desired cryptocurrency from the P2P trading pair and select INR under the Fiat dropdown. Customize your payment options, including NEFT, RTGS, UPI, and IMPS. Binance will then present a list of sellers from whom you can make your purchase.

Step 3 Initiate Purchase:

- In this example, let’s say you want to buy USDT. Specify the amount you wish to purchase and click on Buy USDT (or your chosen cryptocurrency) to proceed.

Step 4 Complete the Transaction:

- Binance will display the seller’s bank account details on the next page. Make the payment from your account to the seller’s account and upload the transaction screenshot to Binance. Once the seller confirms receipt, your P2P trade order will be marked as approved, and the purchased amount will be added to your Binance wallet.

Binance India Fees and More:

- Buy Method: P2P only (direct bank deposit not supported).

- P2P Charges: 0%.

- Supported Crypto Assets in P2P Trading: 10+.

- Payment Methods for P2P: UPI, Bank transfer, IMPS, NEFT, RTGS.

- Crypto Deposit and Withdrawal: Supports various popular cryptocurrencies.

Tax Implications:

A TDS of 1% applies to all P2P trades on Binance India. Buyers must deduct this TDS on the purchase value and deposit it with the Income Tax Department (ITD), along with Form 26QE within 30 days of the month in which the purchase occurred. Additionally, buyers should collect essential documents like the seller’s PAN Card and Aadhaar Card for their records.

It’s crucial to note that while Binance is an international exchange, it does not currently comply with TDS provisions as per Indian laws.

How to buy cryptocurrency on WazirX

As India’s largest crypto exchange, WazirX provides a user-friendly platform for Indian investors to engage in P2P trading and acquire their first cryptocurrency. Follow these simple steps to navigate the process seamlessly.

Quick Steps:

Step 1 Access P2P Trading:

- On WazirX’s homepage, click on P2P to initiate your cryptocurrency purchase. Unlike Binance, WazirX exclusively supports USDT for P2P trading.

Step 2 Enter Buying Details:

- Within the Buy window, input the desired volume of USDT and the price per USDT. Click on Buy, and WazirX will automatically match you with sellers offering crypto at the same price.

Step 3 Verify Seller Details and Make Payment:

- If a match is found, the seller’s details will appear on the next screen, including bank account information and transaction remarks. Make the payment from your WazirX registered bank account to the seller’s account, referencing the provided transaction details.

Step 4 Complete Transaction and Receive USDT:

- After the payment is made, upload the transaction screenshot and click on “I have paid.” Once the seller confirms receipt of payment, the purchased USDT will be credited to your WazirX wallet.

Key Information:

- Buy Method: P2P only (no direct bank deposit).

- P2P Charges: 0%.

- Supported Crypto Assets in P2P Trading: USDT.

- Payment Methods for P2P: UPI, Bank transfer, IMPS, NEFT, RTGS.

- Crypto Deposit and Withdrawal: Supports a limited number of cryptocurrencies.

Safety Insights:

Explore the safety aspects of buying crypto on WazirX in our comprehensive Best Crypto Exchanges India Guide.

How to buy cryptocurrency on CoinDCX

CoinDCX, ranking as India’s third-largest crypto exchange, offers Indian investors a straightforward method of buying crypto through bank deposits. Here’s a step-by-step guide to assist you in acquiring your first cryptocurrency on CoinDCX.

Quick Steps:

Step 1 Access Your INR Wallet:

- Begin on the homepage by navigating to Funds and selecting INR Wallet from the drop-down menu.

Step 2 Initiate Bank Deposit:

- On the next page, choose “Deposit INR to Wallet.” Enter the desired deposit amount, select your preferred bank transfer method, and proceed. Complete the bank transfer by entering the transaction reference number and submit. Your funds will reflect in your INR wallet within 1-8 hours.

Step 3 Navigate to Spot Market:

- Once your deposit is confirmed, head to the spot market on CoinDCX to purchase your chosen cryptocurrency.

Key Information:

- Buy Method: Bank deposit.

- Deposit Fees: 0%.

- Trading Fees: 0.5% (details available).

- Payment Methods: IMPS, NEFT, RTGS.

- Crypto Deposit and Withdrawal: Support for USDT only.

Safety Insights:

Explore the safety aspects of buying crypto on CoinDCX in our comprehensive Best Crypto Exchanges India Guide.

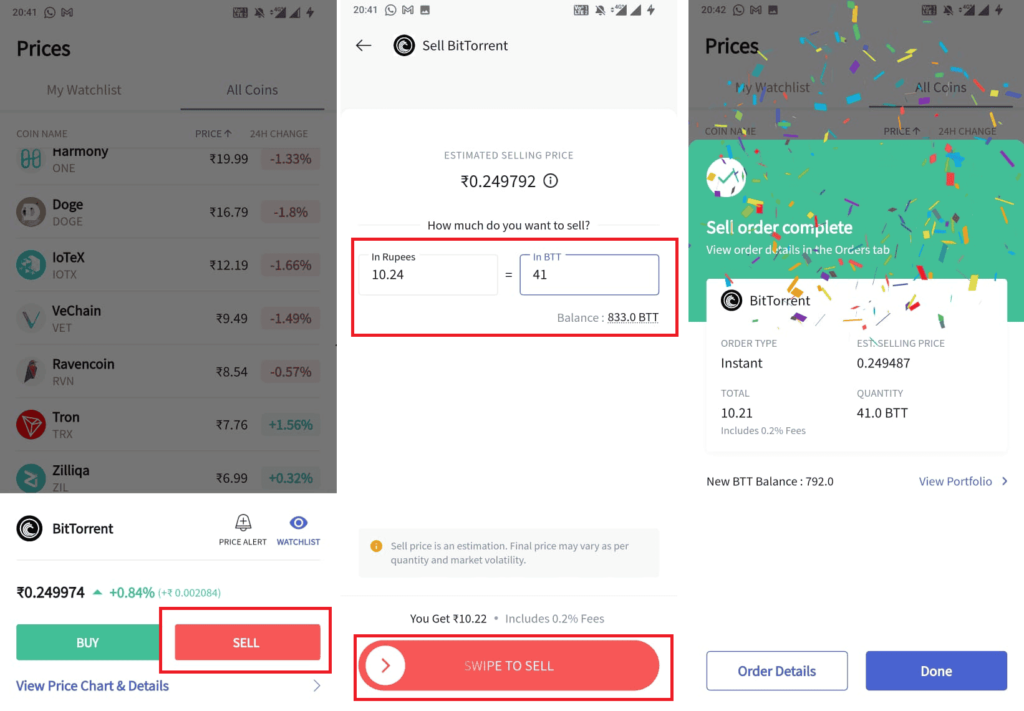

Selling Bitcoin

When you’re ready to sell your Bitcoin, it’s a straightforward process on your chosen exchange. Just like when you bought it, you place a sell order. Exchanges usually offer different order types, allowing you to set conditions or execute an immediate transaction. You can decide to sell your entire Bitcoin holdings or a specific amount. After the sale, the funds can be transferred to your linked bank account, but keep in mind that some exchanges may have a holding period.

If the sale results in a profit, be prepared for capital gains taxes, as reporting cryptocurrency sales on your taxes is now a requirement. The selling process mirrors the simplicity of buying, emphasizing the need to understand order types, decide on the sale amount, and navigate any holding periods imposed by the exchange. For more insights, refer to our comprehensive guide on optimizing cryptocurrency transactions and managing tax implications.

How to Store Bitcoin?

Storing Bitcoin securely is paramount, and this involves utilizing a blockchain wallet. This digital wallet not only safeguards your cryptocurrency but also manages essential keys for transactions, encryption, and information signing, ensuring the utmost safety for your funds. Let’s explore the two main types of wallets available in the crypto space.

Wallet Types:

Cold Wallets:

Cold wallets prioritize security by storing users’ private keys offline. Working in tandem with compatible software on a computer, these wallets provide an added layer of protection. Since they don’t store information digitally, cold wallets are renowned for their heightened security measures.

Hot Wallets:

Hot wallets, on the other hand, operate with internet connectivity, allowing users to execute basic transactions seamlessly. They are categorized based on their software usage, including:

- Desktop Wallets

- Web Wallets

- Mobile Wallets

Each type of hot wallet offers distinct advantages, catering to different user preferences and needs.

What does buying crypto in India mean for your taxes?

Understanding the tax implications of buying cryptocurrency in India is crucial, and the rules vary based on the method and platform used for these transactions. Let’s delve into the intricacies to provide clarity on your tax responsibilities.

Tax Considerations:

- TDS on Crypto Purchases: Purchasing crypto in India attracts a 1% Tax Deducted at Source (TDS). When using an Indian crypto exchange, this TDS is typically deducted on your behalf.

- International Exchanges and TDS: If you opt for international exchanges like Binance, Huobi, or KuCoin, the responsibility of deducting the 1% TDS shifts to the buyer. Buyers must deduct and deposit this amount with the government, providing the necessary details of the seller.

- Crypto-to-Crypto Transactions: Engaging in crypto-to-crypto transactions, such as buying Ethereum (ETH) with Bitcoin (BTC), is considered a taxable event by the Indian government. The transaction is viewed as two separate actions: a sell and a buy. Profits from the sale are subject to a 30% tax (plus surcharge and cess), and an additional 1% TDS is applicable.

Tax Return Process:

Upon filing your tax return, the TDS deposited can offset your Income Tax liability, assuming accurate and timely filing. If your TDS exceeds the Income Tax due, you may be eligible for a refund.

Conclusion – How to buy cryptocurrency in india

Investing in Bitcoins in India promises attractive returns, but it’s crucial to acknowledge the inherent volatility of this relatively new financial instrument. With the Reserve Bank of India (RBI) yet to confer legal status on Bitcoins, the risk of potential capital loss adds an extra layer of complexity for investors. The evolving regulatory landscape and the absence of a clear legal framework emphasize the need for a cautious approach. Aspiring investors should conduct thorough risk assessments, considering uncertainties and potential downsides before entering the cryptocurrency market. Our concise guide provides essential insights for making informed decisions in the dynamic world of Bitcoin investments in India.