Cryptocurrency has become a hot topic in recent years. With the rise of Bitcoin and other digital currencies, many people are interested in learning more about this new form of money. In this beginner’s guide, we will cover all the basics of cryptocurrency and how it works.

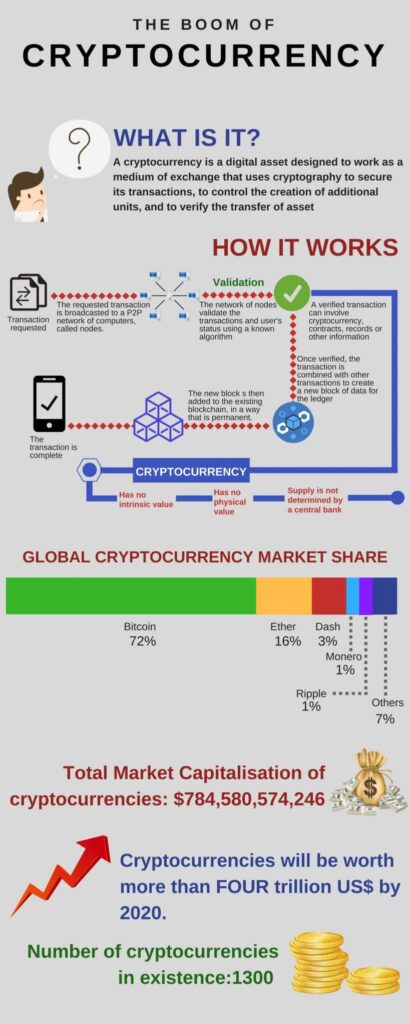

What is Cryptocurrency?

Cryptocurrency is a form of digital currency that uses cryptography to secure transactions and control the creation of new currency units. Unlike traditional “fiat” currencies like the U.S. dollar that are issued by central banks, cryptocurrencies operate independently of any central authority.

Here are some key things to know about cryptocurrency:

- Cryptocurrencies are digital currencies that can be used to buy goods and services, but do not physically exist as coins or notes. They only exist digitally.

- Cryptocurrency transactions are recorded on a public ledger called the blockchain. This allows anyone to verify transactions without the need for a central authority like a bank.

- Cryptocurrencies use cryptography (complex math puzzles) to ensure the security and anonymity of transactions as well as create new coins.

- There are thousands of different cryptocurrencies, but some of the most popular are Bitcoin, Ethereum, Litecoin, and Ripple.

- Cryptocurrencies can be bought on crypto exchanges using conventional money like dollars, and held as investments or used to pay for things electronically.

| Next Up In Investing |

| What is Cryptocurrency? Basic Definitions |

| How Many Cryptocurrencies Are There? |

| How Does Cryptocurrency Work? Blockchain Tech |

| Is Cryptocurrency a Scam? |

How Cryptocurrency Works

Cryptocurrencies like Bitcoin rely on a technology called blockchain to record and verify transactions. Here’s a basic overview of how cryptocurrency transactions work:

- Transactions are requested by sending cryptocurrency from one wallet address to another wallet address.

- Transactions are recorded in “blocks” that are then added sequentially to form a “chain” of blocks (the blockchain).

- A network of computers (called “miners”) use computing power to verify the transaction and record it on the blockchain by solving complex math problems.

- After a transaction is verified, it is permanently recorded on the blockchain across the network. The transaction can’t be altered or deleted.

- For their work verifying transactions, miners are rewarded with new cryptocurrency tokens.

- Each cryptocurrency has a blockchain ledger that records every transaction from the beginning.

This decentralized verification process ensures that transactions can’t be tampered with. Since there is no central authority like a bank or government controlling cryptocurrencies, blockchain technology provides security through transparency and encryption.

What is Cryptocurrency Exchange?

A cryptocurrency exchange is a platform that allows you to buy and sell various cryptocurrencies. Major exchanges include Coinbase, Binance, Kraken and Gemini. These exchanges allow you to trade cryptocurrencies for other assets like conventional money (fiat currencies like USD and EUR).

Here are some things that cryptocurrency exchanges allow you to do:

- Deposit currency – Transfer money from your bank account to purchase cryptocurrency like Bitcoin or Ethereum. The money you deposit becomes your balance to trade with.

- Place buy/sell orders – You can place orders to buy or sell crypto coins at a specific price. Orders get filled when there is a matching buy/sell order.

- Store coins in a wallet – After buying crypto, you need to store it securely in a cryptocurrency wallet. Exchanges provide digital wallets to hold your purchased coins.

- Trade between cryptocurrencies – Convert between various coins like trading Bitcoin for Ethereum. Trading between coins means selling one to buy another.

- Withdraw currency – Sell cryptocurrency on the exchange and withdraw the proceeds back to your bank account.

The major benefit of using an exchange is that it provides an easy way to convert between cryptocurrencies and fiat money.

Best Cryptocurrencies

There are thousands of cryptocurrencies on the market today. But these are some of the most well-known and highly-valued coins based on their market capitalization (total value):

- Bitcoin (BTC) – The first and largest cryptocurrency by market cap. Bitcoin serves as a digital store of value and is commonly called “digital gold.”

- Ethereum (ETH) – The second largest crypto coin that is focused on running decentralized smart contracts and apps instead of just being a digital currency.

- Litecoin (LTC) – A faster and cheaper version of Bitcoin. Litecoin processes transactions faster than Bitcoin.

- Cardano (ADA) – A proof-of-stake blockchain platform with a native cryptocurrency designed to allow smart contracts and decentralized applications.

- Binance Coin (BNB) – The native coin of the popular Binance cryptocurrency exchange that allows discounted trading fees.

- Tether (USDT) – A stablecoin pegged to the U.S. dollar to minimize volatility, allowing cryptocurrency users to avoid fluctuations.

This is just a small sample – there are many other significant cryptocurrencies and the landscape is constantly evolving. Do thorough research before investing in any coin.

How to Buy Cryptocurrency

Here is a step-by-step guide to buying cryptocurrency:

- Select a cryptocurrency exchange – Major exchanges include Coinbase, Kraken, Gemini and Binance. Accounts can be created easily on a mobile app or website.

- Verify your identity – Exchanges require verification of your identity by providing photo ID and other documents to follow KYC (know your customer) regulations.

- Fund your account – Deposit currency like USD into your exchange account by linking a payment method like a bank account. This money will be used to buy crypto.

- Place a buy order – Find the coin you want to buy and place an order by specifying how much you want to purchase.

- Secure your coins – Withdraw the cryptocurrency from the exchange to a secure wallet that you control to store your coins safely.

- Manage your portfolio – Consider diversifying into different cryptocurrencies and manage your portfolio over time.

Major cryptocurrency exchanges like Coinbase and Gemini make it easy to link your bank account and buy crypto in minutes. Then you need to withdraw your coins to a secure wallet.

How to Invest in Cryptocurrency

Here are some tips for investing in cryptocurrency strategically:

- Only invest what you can afford to lose – Cryptocurrency is highly volatile, so only use discretionary income.

- Do your research – Learn as much as possible about each coin’s technology, roadmap and leadership before investing. Stay up to date on crypto news.

- Diversify – Invest in a variety of cryptocurrencies and do not put all your money into one coin. Diversity reduces risk if one coin fails.

- Consider long-term potential – The crypto market is still young, so review projects with long-term viability instead of chasing temporary hype and spikes.

- Use dollar cost averaging – Invest set amounts at regular intervals instead of all at once. This smoothes out volatility.

- Protect your coins – Keep coins in your own personal crypto wallet instead of on an exchange long-term. This gives you control of your private keys.

- Develop an exit strategy – Determine sale points in advance to take profits on the way up and minimize losses if prices fall.

Do not simply jump into trading crypto randomly. Develop a strategic investment approach tailored to your specific goals and risk tolerance. Be prepared to hold positions long-term as the crypto market matures.

Cryptocurrency Mining

Cryptocurrency mining is the process of validating new transactions and adding blocks to the blockchain. Miners use specialized hardware and software to solve complex math problems that verify transactions. Here are the basics of how crypto mining works:

- Mining rigs run algorithms to solve cryptographic math problems that generate proof of work to validate transactions without any central authority.

- Successfully adding a block to the blockchain requires guessing the correct parameters and computations to verify the pending transactions.

- The first miner to get the computations right and validate the block gets rewarded with newly minted crypto tokens.

- Miners compete against each other to be the first to validate new transactions and get the mining rewards.

- As more miners join the network and mining difficulty increases, the amounts of power and electricity required to mine new coins also increases.

- Major mining operations now use large data centers with thousands of high-powered mining rigs running 24/7.

- Mineable cryptocurrencies include Bitcoin, Litecoin and Ethereum. Coins like Ripple instead rely on a consensus protocol for validation so mining is not required.

While crypto mining can potentially yield lucrative block rewards, it requires significant upfront investment in hardware, electricity costs and maintenance. It has now become very resource intensive and difficult for individual miners.

Cryptocurrency Trading

Cryptocurrency trading involves buying and selling digital coins in an attempt to profit from price fluctuations in the market. Here are some tips to get started with crypto trading:

- Choose reputable exchanges like Coinbase, Binance or Kraken to gain access to trading pairs between different cryptocurrencies and fiat currency.

- Analyze the crypto market to identify trading opportunities by using price charts, volatility indicators, moving averages and technical analysis.

- Develop a trading strategy with clear risk/reward ratios. Strategies can utilize leverage, derivatives like futures contracts or simple buy and hold.

- Set up market orders to enter and exit positions when certain price levels are reached to lock in profits and limit losses.

- Keep updated on crypto news, events and new coin listings to identify market moving events early on.

- Use stop-loss orders to automatically exit losing positions at predetermined price levels to contain downside.

- Dollar cost average into positions over time instead of buying all at once to reduce risk and smooth entry.

- Don’t chase pumps or get caught up in hype that can lead to bad trades. Stick to high volume coins with liquidity.

As with any trading, crypto trading carries significant risk and requires education, training and discipline. But the high volatility of crypto also brings opportunities for gains.

Cryptocurrency Wallet

A cryptocurrency wallet is a secure digital wallet used to store, receive and send cryptocurrency transactions. Wallets come in different forms:

Software Wallets

- Desktop – Downloadable software to store coins on your computer, like Exodus.

- Online – Web based wallets accessible anywhere with login credentials, like Coinbase wallet.

- Mobile – Apps that store crypto balances on your phone, like Trust Wallet.

Hardware Wallets

- Offline physical storage devices not exposed online, providing cold storage, like Trezor and Ledger.

Key features that make cryptocurrency wallets secure include:

- Private keys – Allow access to the wallet and sign transactions using cryptography and digital signatures. Never share private keys.

- Seed phrase – A 12-24 word passphrase that can regenerate private keys if you lose access, similar to a password. Keep the seed phrase private and secure.

- Cold storage – Keep the majority of holdings in wallets not connected online to avoid hacking risks. Only keep a small amount in hot wallets.

- Multi-signature – Require multiple private keys to sign and authorize transactions for enhanced security. Useful for large balances.

- Read-only access – Address can only be used to verify balance or receive funds but not spend or send transactions. Added security benefit.

Choosing the right wallet involves balancing security needs with convenience. Do your own research to find the best solution tailored to your specific circumstances and holdings.

How to Make Money with Cryptocurrency

Here are some of the main ways to generate income and make money with cryptocurrency:

- Trading – Buying low and selling high to profit from price appreciation over time. Requires in-depth market analysis and disciplined risk management.

- Mining – Validating transactions and minting new coins by contributing computing power. Requires high-end equipment and low electricity costs to be profitable.

- Staking – Locking up crypto holdings to participate in transaction validation and earn rewards and interest in proof-of-stake coins like Ethereum.

- Lending – Provide crypto assets as collateral to decentralized lending pools to earn interest paid by borrowers. DeFi platforms like Aave facilitate lending.

- Airdrops – Getting free crypto coins by holding certain tokens, engaging with new projects or being an active community member.

- Bounties – Completing tasks like promoting projects, finding bugs and growing communities to earn crypto rewards.

- Working for crypto – Instead of actual fiat paychecks, take a portion of salary in cryptocurrency.

- Accepting payments – Integrate crypto payment gateways to accept coins like Bitcoin from customers for goods/services.

There are many creative ways to generate crypto income beyond just buying and holding coins long-term as an investment. Consider your unique interests and abilities to develop a strategic approach.

Best Way to Earn Passive Income with Cryptocurrency

Here are some of the most popular methods for earning passive crypto income:

- Staking – Earn staking rewards and interest by participating in proof-of-stake networks like Ethereum 2.0 as a validator. Requires locking up coins to earn roughly 5-10% APY.

- Lending – Lend your crypto assets to lending pools on DeFi platforms like Aave, Compound Finance or Celsius Network to earn interest from borrowers. Interest paid can be from 3-12% typically.

- Yield Farming – Provide liquidity to decentralized exchanges and liquidity pools in return for fees and governance tokens that can appreciate in value. Riskier but higher reward potential.

- Masternodes – Provide a specific amount of coins like DASH or NEO to operate a masternode that verifies transactions for block rewards and fees. Requires technical setup.

- Referral bonuses – Refer friends and followers to platforms like crypto exchanges, wallets and lending platforms to earn kickbacks in cryptocurrency.

- Airdrops – Sign up for new crypto projects, complete tasks and hold certain coins to get free airdropped coins that can accumulate or appreciate over time.

The key to earning significant passive income with crypto is to stake and invest coins you intend to hold long-term instead of actively trading. Interest and staking rewards will accumulate substantially over months and years.

Conclusion

Cryptocurrency represents an emerging new financial system outside of government control and centralized intermediaries. While still early stage, blockchain technology promises to improve transparency, security and accessibility for financial transactions.

With proper education and precaution, individuals now have expanded financial freedom and opportunity to store and generate wealth in the form of digital currencies. However, cryptocurrency investing also carries significant volatility and risk.

This beginner’s guide summarizes all the core concepts for understanding the basics of cryptocurrency and how the technology functions. There is still much to learn about utilizing crypto safely, effectively and strategically. Take time to deeply research before getting started investing in this powerful but complex new market.