In the world of cryptocurrencies, safeguarding assets is paramount, and a cold Bitcoin wallet plays a pivotal role in enhancing security. Unlike their internet-connected counterparts, cold wallets keep private keys offline, providing robust protection against cyber threats. With various options available, choosing the right cold wallet is essential to secure digital assets.

In the cryptocurrency landscape, diverse cold storage wallets offer unique features. This article explores the definition, use cases, and pros and cons of cold wallets before spotlighting the top five options. These wallets stand out for their exemplary security and user-friendly interfaces, ensuring a seamless experience in protecting digital wealth.

Navigating the market requires a discerning eye, and this blog post serves as a guide to empower readers with the knowledge needed to select the ideal cold Bitcoin wallet.

What is a cold Bitcoin wallet?

A cold Bitcoin wallet is a specialized type of cryptocurrency wallet crafted to store private keys offline, introducing an additional layer of security against hacking, malware attacks, and other potential threats. Private keys serve as the gateway to managing and accessing cryptocurrency assets, and by maintaining them offline, cold wallets significantly raise the bar for malicious actors attempting unauthorized access to your digital holdings.

Among cold wallets, hardware wallets stand out as the most popular choice. These physical devices, akin to USB drives, securely store private keys. On the other hand, paper wallets, which are printed copies of private keys, are deemed highly secure but can be susceptible to loss or damage.

Cold wallets offer distinct advantages over their hot wallet counterparts. They enhance security and instill confidence by keeping digital assets offline. However, it’s important to acknowledge that cold wallets may entail less convenience compared to hot wallets, posing potential challenges for new users. Additionally, maintaining backup copies of the private key is crucial to address the risk of loss or damage to the cold wallet.

When Cold Bitcoin Wallet Uses?

A cold Bitcoin wallet serves various purposes depending on the owner’s objectives. If these use cases don’t align with your cryptocurrency goals, sticking with hot wallets might be more suitable.

- Long-Term Security Investment For secure, long-term storage of digital assets like cryptocurrencies, a cold Bitcoin wallet is optimal due to its higher cost and enhanced security features.

- Resilience Against Malware and Viruses Cold wallets excel in protecting financial assets from malware and viruses by disconnecting access keys from the internet, eliminating online hacking risks.

- Storage of Diverse Assets Contrary to misconceptions, cold wallets aren’t limited to cryptocurrencies. They securely store various assets on the blockchain, making them ideal for different high-value investments.

- Advanced Backup and Recovery Reputable cold wallet providers offer advanced recovery and backup utilities, addressing potential loss issues associated with cold wallet use.

- Facilitating Offline Transactions Cold wallets enable secure offline transactions, making them ideal for off-the-grid and anonymous financial exchanges, including large gifts or donations.

Potential Disadvantages of a Cold Storage Wallet

Now that we are familiar with a cold wallet’s advantages and use cases, it’s good to know some of its potential advantages. None of these “cons” are really hindering if you are truly going to use a cold storage wallet for what it is meant to be used as, a long-term, secure, transactionally limited investment.

| Potential Advantages | Potential Disadvantages |

|---|---|

| – Long-term Security | 1. Costs: Cold wallets can be expensive, requiring a substantial initial investment. |

| – Transactional Limitation | 2. Learning Curve: Operating a cold wallet may be more complex and require technical knowledge. |

| – Protection from Online Threats | 3. Potential for Physical Loss or Damage: Cold wallets, being physical devices, can be lost or damaged, leading to fund loss without proper backup and recovery. |

| 4. Limited Accessibility: Cold wallets are not as easily accessible as hot wallets, hindering smooth online fund movement. |

Is it better to have a cold or hot wallet for Bitcoin?

The decision between a cold wallet and a hot wallet can be intricate, but let’s simplify it. A cold storage wallet, a physical hardware device disconnected from the internet, is deemed more secure. Storing private keys offline makes cold wallets less susceptible to hacking or online attacks, making them an excellent choice for those planning long-term cryptocurrency storage (or ‘Hodling,’ as some crypto enthusiasts say). Just ensure you safeguard your offline access keys.

On the flip side, a hot wallet, based on software architecture, is connected to the internet and is also known as an online wallet. It enables users to access their funds from any device with an internet connection, making it convenient for frequent trading or transactions. Hot wallets, accessed through a web browser or mobile app, are suitable for day trading and handling small to medium amounts of crypto but are not the ideal choice for long-term savings. It’s crucial to explore the best crypto trading bots to navigate this aspect effectively.

| Deciding Factors | Hot Wallet | Cold Wallet |

|---|---|---|

| Price | Usually free, some offer interest on stored crypto. | Requires the purchase of an external device, costing around $50 to $250. |

| Better for | Convenient access and use for trading. | Long-term storage. |

| Maximum number of cryptos | Can store one to tens of thousands. | Can store from 1,000 to tens of thousands. |

| Cybersecurity | Average, connected to the internet, potential vulnerability to hacking. | Excellent, can’t be accessed online, but security measures are necessary. |

| Loss protection | Good, with recovery and backup options, accessible from multiple devices. | Average, recovery and backup options for a lost password, not for a lost device. |

| Ease of transfer to exchanges | Excellent, as hot wallets are internet-connected. | Average, requires an extra step to connect online through USB, Wi-Fi, or QR code. |

10 Best Cold Bitcoin Wallets in 2024

1. Trezor Model One – Overall Best Cold Wallet for 2024

The Trezor Model One stands out as a top-performing cold wallet, even as Trezor’s entry-level model. With robust security features, including a customizable PIN for transaction verification, it ensures that transactions cannot be authorized remotely. Users receive a 12 or 24-word backup passphrase, allowing for remote recovery in case of forgotten PINs or device loss.

This cold wallet seamlessly integrates with the Trezor Suite, supporting convenient access to cryptocurrency holdings on laptops and smartphones. While it excels in security and accessibility, it does not support staking. For staking features, users would need to consider the T Model at $219. Despite this limitation, the Trezor Model One, priced at $69, offers excellent value for those prioritizing long-term safety. Notably, it does not add markups on GAS fees, ensuring direct payment to blockchain miners.

Trezor Model One Overview:

| Type of Wallet | Supported Cryptos | Fees | Mobile App? | Staking/Interest? | Staking/Interest Rate |

|---|---|---|---|---|---|

| Hardware wallet with non-custodial storage | Nearly 1,300 cryptocurrencies, including Bitcoin, Ethereum, and XRP | $69 to buy the device. GAS fees are charged at the real-time rate quoted by miners. Fiat purchases may incur third-party fees of up to 5.75%. | Yes | No | N/A |

Pros:

- Overall best cold wallet for crypto in 2024.

- Competitively priced at $69.

- Supports almost 1,300 cryptocurrencies, including top ERC20 tokens.

- Encrypted private keys are always offline.

- Remote recovery capability via a 12 or 24-word backup passphrase.

Cons:

- Does not support staking.

- Debit/credit card fees of up to 5.75%.

2. Ledger Nano S Plus – Affordable Security at $79

The Ledger Nano S Plus stands as a testament to the accessibility of secure cold storage, priced at just $79. This entry-level model from Ledger offers robust features comparable to the Trezor Model One.

During the wallet setup, users receive a 24-word backup passphrase, displayed on-screen, and are required to create a memorable PIN for transaction authorization. In case of a forgotten PIN, the user can regain access using the backup passphrase.

Ledger Nano S Plus Overview:

| Type of Wallet | Supported Cryptos | Fees | Mobile App? | Staking/Interest? | Staking/Interest Rate |

|---|---|---|---|---|---|

| Hardware wallet with non-custodial storage | Over 5,000 cryptocurrencies across multiple blockchains, including Bitcoin, Ethereum, Polkadot, and Binance Smart Chain | $79 to buy the device. Token swaps, staking, and fiat purchases provided by third parties. | Yes | Yes, provided by third parties. | Depends on the cryptocurrency and the third party. |

The Ledger Nano S Plus ensures remote recovery if lost, damaged, or stolen. Supporting over 5,000 cryptocurrencies, including notable ones like Bitcoin, Polkadot, Binance Smart Chain, XRP, and Ethereum, it offers a wide spectrum of choices.

Furthermore, the Ledger Nano S Plus integrates with Ledger Live, an app and desktop software offering additional features. Users can stake cryptocurrencies for passive rewards, engage in token swaps, and buy cryptocurrencies with fiat money. However, it’s crucial to note that these additional features come from third parties and may involve associated fees.

Pros:

- Cost-effective cold wallet retailing at $79.

- Supports more than 5,000 cryptocurrencies.

- Stores crypto and NFTs across multiple blockchain standards.

- In-built staking tool for earning passive rewards.

Cons:

- All additional features are provided by third parties, potentially incurring high fees.

- Fiat payments require KYC.

3. Trezor Model T – Advanced Cold Storage Device with Touchscreen

The Trezor Model T takes a step further in cold storage technology, priced at $219. This advanced Trezor device shares many security features with the Model One, including offline storage and encrypted private keys.

Distinguishing itself with a touchscreen interface instead of a two-button pad, the Model T offers enhanced convenience in transaction processing. It also adopts the more commonly used USB type-C and supports 167 additional cryptocurrencies compared to the Model One.

Trezor Model T Overview:

| Type of Wallet | Supported Cryptos | Fees | Mobile App? | Staking/Interest? | Staking/Interest Rate |

|---|---|---|---|---|---|

| Hardware wallet with non-custodial storage | Over 1,450 cryptocurrencies, including Bitcoin, Ethereum, and XRP | $219 to buy the device. GAS fees are charged at the real-time rate quoted by miners. Fiat purchases are processed via third parties at fees of up to 5.75%. | Yes | Yes – supports Cardano and Tezos. | Determined by the proof-of-stake network. GAS fees apply. |

The Model T introduces an in-built staking tool, supporting prominent staking coins like Cardano and Tezos. Notably, it expands functionality by allowing users to buy and swap cryptocurrencies. However, these services, as with the Trezor Model One, are facilitated by third parties, often involving higher fees.

Pros:

- Inherits all security features of the Trezor Model One.

- Transaction confirmation via touchscreen.

- Supports USB type-C.

- Allows staking for Cardano and Tezos through the Trezor Suite.

Cons:

- Additional features might not entirely justify the $219 price tag.

- Debit/credit card fees of up to 5.75%.

4. Ledger Stax – Cutting-Edge Crypto Storage at $279

The Ledger Stax, priced at $279, represents Ledger’s advanced offering, featuring Bluetooth support and wireless charging. With a curved touchscreen for convenient transaction verification, it offers a personalized experience with customizable lock screens and embedded magnets.

Ledger Stax Overview:

| Type of Wallet | Supported Cryptos | Fees | Mobile App? | Staking/Interest? | Staking/Interest Rate |

|---|---|---|---|---|---|

| Hardware wallet with non-custodial storage | Over 5,000 cryptocurrencies, including Bitcoin, Ethereum, Polkadot, and Binance Smart Chain | $279 to buy the device. Token swaps, staking, and fiat purchases provided by third parties. | Yes | Yes, provided by third parties. | Depends on the cryptocurrency and the third party. |

Despite the $200 premium over the Ledger Nano S, the Ledger Stax has witnessed high demand, leading to potential buyers being waitlisted.

Pros:

- Curved touchscreen for convenient transaction confirmation.

- Bluetooth connectivity for seamless integration with Ledger Live.

- Personalized experience with customizable lock screens.

Cons:

- Priced $200 higher than the Ledger Nano S.

- High demand has resulted in a waitlist for potential buyers.

5. KeepKey – Budget-Friendly Cold Wallet for Web 3.0

KeepKey is an excellent cold wallet, particularly for Web 3.0 dApp users. It offers secure connectivity through desktop software or smartphone USB connection. Supporting over 7,200 cryptocurrencies, including popular dApps like UniSwap and Aave, KeepKey allows decentralized token swaps and staking. Priced at just $49, it’s a budget-friendly choice.

KeepKey Overview:

| Type of Wallet | Supported Cryptos | Fees | Mobile App? | Staking/Interest? | Staking/Interest Rate |

|---|---|---|---|---|---|

| Hardware wallet with non-custodial storage | 7,200+ cryptocurrencies across 348 network standards | $49 to buy the device. Token swaps and DeFi tools determined by connected dApps. | No, but comes with a USB connector for smartphones | No, but connects to dApps | N/A |

Pros:

- Ideal for budget-conscious investors.

- Connects to any WalletConnect-supported dApp.

- Supports 7,200+ cryptocurrencies.

- Unlimited wallet addresses.

Cons:

- Lacks a dedicated mobile app.

- No in-built staking tools.

6. CoolWallet Pro – Balancing Security and Convenience at $149

CoolWallet Pro strives to achieve an optimal balance between security and convenience, offering a cold wallet device priced at $149. With a dedicated mobile app for iOS and Android, users can initiate transactions on the app before finalizing them on the physical device.

The CoolWallet Pro establishes a secure connection with the app via encrypted Bluetooth, eliminating the need for a USB cable. Compatibility with WalletConnect enables seamless connections to dApps like OpenSea and UniSwap.

CoolWallet Pro Overview:

| Type of Wallet | Supported Cryptos | Fees | Mobile App? | Staking/Interest? | Staking/Interest Rate |

|---|---|---|---|---|---|

| Hardware wallet with non-custodial storage | Over 12,000 cryptocurrencies across 27 network standards | $149 to buy the device. Token swaps and DeFi tools determined by connected dApp. | No, but comes with a USB connector for smartphones | Yes, supports Everstake and Lido. Staking coins include Ethereum, Cardano, Cosmos, Solana, and Tezos. | Determined by the chosen proof-of-stake network |

CoolWallet Pro stands out with support for 27 blockchain networks, covering over 12,000 cryptocurrencies, including major ones like Bitcoin, Ethereum, BNB, Polkadot, Cardano, and Solana. Its lightweight, credit card-like design adds to its popularity.

Pros:

- Supports over 12,000 cryptocurrencies across 27 blockchains.

- Native mobile app for streamlined transactions.

- Bluetooth connectivity eliminates the need for WiFi and USB cables.

- In-built staking tools for various Proof-of-Stake (PoS) coins.

Cons:

- Lack of desktop software.

- Website contains poorly-worded English.

- Cheaper alternatives are available elsewhere.

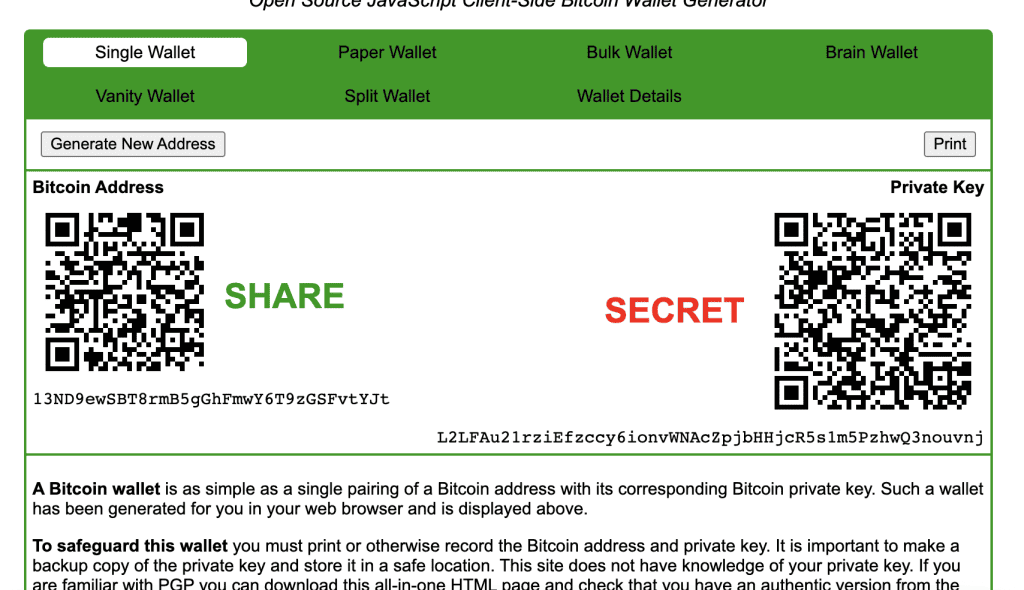

7. BitAddresses – Free Cold Storage for Bitcoin

BitAddresses is an ideal cold storage solution for budget-conscious investors, offering paper storage for free. Users can generate Bitcoin addresses and private keys as QR codes, print them on paper, and securely store them offline. While exclusive to Bitcoin, funds can be transferred by importing private keys into another wallet.

BitAddresses Overview:

| Type of Wallet | Supported Cryptos | Fees | Mobile App? | Staking/Interest? | Staking/Interest Rate |

|---|---|---|---|---|---|

| Paper wallet with non-custodial storage | Bitcoin | None | No | No | N/A |

Pros:

- Free cold wallet option.

- Unlimited creation of Bitcoin addresses.

- Private keys printable as QR codes.

Cons:

- Transfer process less convenient than hardware wallets.

- Exclusive support for Bitcoin.

BitAddresses offers a cost-effective solution for securing Bitcoin offline, making it a straightforward choice for free cold storage.

8. SafePal S1 – Affordable Cold Wallet with Air-Gapped Security

Priced at just $49, the SafePal S1 offers top-notch security through its air-gapped signing mechanism. This unique feature allows users to sign transactions without the need for cables, Bluetooth, or WiFi connections.

In operation, users set up outgoing transactions on the SafePal S1 app or browser extension, compatible with iOS, Android, Chrome, Edge, and Firefox. After inputting transaction details, a unique QR code is generated, which users then scan with the SafePal S1 device equipped with an in-built camera.

SafePal S1 Overview:

| Type of Wallet | Supported Cryptos | Fees | Mobile App? | Staking/Interest? | Staking/Interest Rate |

|---|---|---|---|---|---|

| Hardware wallet with in-built camera | Over 30,000 cryptocurrencies across multiple networks, including emerging cryptocurrencies | $49 to buy the device. 0.3% token swap fee. Fiat payments through Simplex, with fees averaging 3.5-5%. | Yes | Yes, in-built staking and yield farming tools provided by Binance Earn | Varies depending on the cryptocurrency and product |

The user confirms the transaction by entering their PIN on the SafePal S1 device. Notably, SafePal S1 supports an extensive range of cryptocurrencies across different network standards, encompassing Bitcoin, Ethereum, Fantom, Optimism, Polkadot, Polygon, and Binance Smart Chain.

Pros:

- Air-gapped signing mechanism eliminates the need for internet, cable, or Bluetooth connections.

- Transaction verification through QR codes, scanned by the device.

- Native iOS and Android app support for cryptocurrency management.

- In-built Binance API for trading and staking.

- Affordable price of $49.

Cons:

- No desktop software available.

- 0.3% token swap fee.

SafePal S1 stands out as an economical choice with robust security features, making it an attractive option for users prioritizing affordability and advanced security in a cold wallet.

9. SecuX V20 – Versatile Cold Wallet for 10,000+ Cryptocurrencies

For diverse investors, the SecuX V20 offers a comprehensive solution, supporting over 10,000 cryptocurrencies across 300 blockchains. Priced at $139, this hardware wallet features a large 2.8-inch touchscreen for convenient transaction processing and portfolio monitoring.

SecuX V20 Overview:

| Type of Wallet | Supported Cryptos | Fees | Mobile App? | Staking/Interest? | Staking/Interest Rate |

|---|---|---|---|---|---|

| Hardware wallet with app and web-based interface | 10,000+ cryptocurrencies across 300 blockchains | $139 for the device. Supports debit/credit card purchases through Coinify. | Yes | Yes, supports FIO tokens | APYs not published by SecuX V20 |

Initiating transfers involves entering transaction details on the app or website, securing them via Bluetooth. Confirmation requires a PIN on the device. USB type-C support and a backup passphrase enhance user convenience.

Pros:

- Transaction setup via app or web.

- Offline transactions through Bluetooth or USB.

- Support for 300 blockchains and 10,000+ cryptocurrencies.

- Spacious touchscreen interface.

Cons:

- Staking limited to FIO tokens.

- Coinify used for fiat payments.

SecuX V20 excels as a versatile cold wallet, catering to diverse crypto portfolios with its extensive compatibility and user-friendly design.

10. ELLIPAL Titan – Secure 4-Inch Touchscreen Cold Wallet

Consider the ELLIPAL Titan as the concluding cold wallet in our list. This hardware device, weighing 340g and featuring a 4-inch metal body, boasts a remarkable 259-hour battery life. The ELLIPAL Titan sets itself apart by conducting air-gapped transactions, eliminating the need for Bluetooth, WiFi, or any external connections.

Key Features of ELLIPAL Titan:

| Type of Wallet | Supported Cryptos | Fees | Mobile App? | Staking/Interest? | Staking/Interest Rate |

|---|---|---|---|---|---|

| Hardware wallet with app and camera | 10,000+ cryptocurrencies across 52 blockchains, including Bitcoin, Ethereum, Solana, and Binance Smart Chain | $139 for the device. Fiat payments through Changelly (fees included). | Yes | Yes, supports Cardano, Cosmos, Polkadot, and Tezos | Up to 10% APY |

Transactions are verified using a 5M AF camera, scanning QR codes generated on the native app. The ELLIPAL Titan provides unlimited storage and supports more than 52 blockchains and 10,000 cryptocurrencies, covering Bitcoin, ERC20 tokens, and BSC tokens.

The ELLIPAL Titan app integrates with Changelly for fiat transactions and supports staking for various coins like Cardano, Cosmos, Polkadot, and Tezos. The wallet also connects to dApps via MetaMask or WalletConnect.

Pros:

- Air-gapped transactions for enhanced security.

- 4-inch device with a 5M AF camera for QR code verification.

- In-built staking tools with APYs of up to 10%.

Cons:

- Fiat transactions processed by Changelly.

- Heavier compared to most other hardware wallets.

The ELLIPAL Titan stands out for its robust security features, extensive cryptocurrency support, and convenient transaction verification through air-gapped technology.

Conclusion: Making Informed Wallet Choices

Cold wallets prove ideal for long-term investors managing substantial portfolios due to their secure, offline nature, protecting against remote hacking threats. With the added benefit of fund recovery through backup passphrases in case of loss or theft, they offer robust security.

However, not all investors find cold wallets suitable, particularly those actively involved in frequent buying, selling, and trading of cryptocurrencies. For such individuals, a hot wallet may present a more fitting option.

If you’re still uncertain about choosing between a hot or cold wallet, explore our comprehensive guide on the best crypto wallets for 2024 to make an informed decision tailored to your needs.