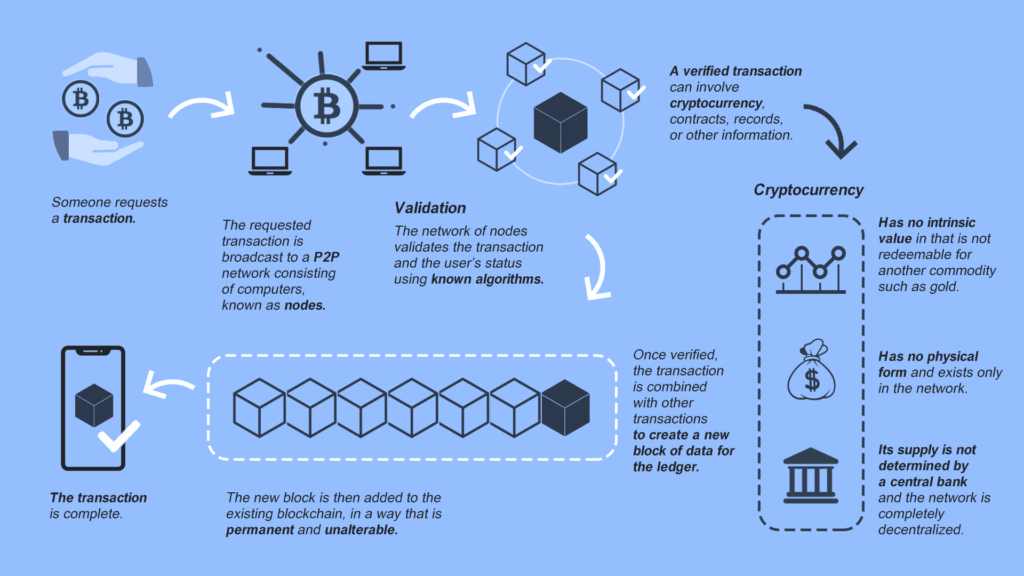

In the dynamic landscape of digital transactions, Bitcoin Exchange emerges as a groundbreaking means for exchanging value, akin to traditional cash but in the digital domain. This versatile cryptocurrency allows users to swap it for a myriad of assets, bypassing intermediaries like banks or payment applications.

Diverse platforms and methods facilitate the exchange of Bitcoin for other assets, including cryptocurrency exchanges, peer-to-peer transactions, and transactions for goods and services. However, the go-to method for many remains the specialized Bitcoin exchange. These purpose-built platforms streamline the process, ensuring a seamless, rapid, and efficient exchange experience, marking them as the predominant choice for those looking to diversify their cryptocurrency holdings.

What’s a bitcoin exchange?

In the expansive realm of digital finance, a Bitcoin Exchange stands as a virtual marketplace, providing individuals with the platform to engage in buying, selling, or trading Bitcoin. This dynamic exchange extends beyond Bitcoin transactions, enabling users to interchange their cryptocurrency holdings with other digital assets or traditional fiat currencies.

Think of these crypto exchanges as a digital counterpart to stock exchanges, where instead of dealing with stocks, users immerse themselves in the world of cryptocurrencies and various digital assets. This unique marketplace fosters a fluid environment for users to navigate the complexities of digital currency transactions and explore the diverse landscape of crypto trading.

Is it safe to use a cryptocurrency exchange?

Entrusting your assets to a cryptocurrency exchange for storage or trading poses significant risks. Instances of complete asset loss or extended restrictions due to bankruptcy are not uncommon. Following the crypto adage, “Not your keys, not your coins,” highlights the importance of having control over your assets by using your own wallet.

Exchanges, often targeted by hackers due to the substantial currency they hold, have faced notable breaches, such as Mt. Gox in 2014 and Crypto.com in January 2022.

Unlike regulated banks and securities brokers in the U.S., cryptocurrency exchanges lack similar oversight, making it challenging for users to assess their trustworthiness. Unregistered exchanges operate without specific governmental regulations or protections, potentially resulting in the loss of the entire value of deposited digital assets if they fail. Caution and thorough research are essential to safeguard your investments when dealing with cryptocurrency exchanges.

Types of Crypto Exchanges

A Bitcoin exchange serves as the hub for cryptocurrency transactions, offering a spectrum of services. Determining the right exchange involves aligning with individual financial goals and risk tolerance. Various types of crypto exchanges cater to distinct needs:

- Brokers: While not exclusively crypto exchanges, some traditional securities brokers act as intermediaries in crypto markets. These brokers set prices for buying and selling digital assets, and over-the-counter brokers are utilized for substantial orders, preventing slippage.

- Traditional Crypto Exchanges: Platforms facilitating the buying and selling of digital assets based on daily market prices. They may charge transaction fees and can operate either solely in cryptocurrency or allow fiat-to-crypto trading. Two main types include:

- Centralized Cryptocurrency Exchanges: Overseen by a third party to ensure smooth operations, these exchanges offer quick access to linking bank accounts or cards but often come with additional fees.

- Decentralized Cryptocurrency Exchanges (DEXs): Embodying the essence of blockchain’s decentralization philosophy, DEXs operate without third-party oversight, relying on peer-to-peer trading. Although more technically demanding, they uphold the principle of decentralized currency movement.

How do centralized exchanges work?

When using a centralized exchange (CEX), the user experience closely mirrors that of traditional online brokerages or bank accounts. The process typically unfolds as follows:

- Account Creation: Select a centralized exchange, create an account by providing basic details like email, password, and sometimes additional information for regulatory compliance and verification.

- Verification Process: Being regulated entities, centralized exchanges adhere to Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations. Users must complete a verification process, submitting identity documents and, at times, proof of address.

- Funds Deposit: Once verified, users can deposit funds into their exchange accounts, with the option to deposit cryptocurrencies like BTC or fiat currency such as USD or EUR. Some exchanges facilitate linking bank accounts or using credit cards for deposits.

- Trading Execution: Choose the cryptocurrency for buying or selling, with the flexibility to place different order types, including market orders (instantly transacted at the current market price) or limit orders (executed at a specific price). Specify the trade amount and confirm transaction details.

It’s crucial to bear in mind that when your bitcoin and digital assets reside on the exchange, you’re relying on the exchange for their security, in contrast to holding them in a self-custody wallet. Understanding this dynamic is essential for users navigating the centralized exchange landscape.

How do decentralized exchanges work?

When it comes to decentralized exchanges (DEXs), the direct exchange of Bitcoin is not feasible, but there are derivative products like WBTC that enable this.

From a user’s perspective, engaging with a DEX can be both empowering and slightly more technical compared to a centralized exchange (CEX). Here’s a breakdown of how it typically works:

- Wallet Setup: Prior to using a DEX, it’s essential to have a compatible cryptocurrency wallet, such as the multichain Bitcoin.com Wallet app. Opting for a self-custody wallet ensures full control over your assets.

- Wallet Funding: Transfer some cryptocurrency to your wallet, either from another wallet or a centralized exchange where you hold cryptocurrencies.

- DEX Connection: Visit the website of your chosen DEX, like Verse DEX. Look for the option to connect a wallet, choose your wallet type, and approve the connection request within your wallet app. This establishes a link between your wallet and the DEX, enabling you to initiate trades.

- Trading on the DEX: Once your wallet is connected, you’ll encounter an interface allowing you to choose the cryptocurrency you want to swap and specify what you wish to receive in exchange. For instance, you might decide to exchange Ether (ETH) for VERSE.

What’s a banked exchange?

Bitcoin exchanges offer varying degrees of banking functionality. Those enabling local currency deposits and withdrawals are labeled ‘banked exchanges.’ (typically in the form of credit card or payment app like PayPal). In contrast, ‘partially banked’ exchanges permit local currency deposits but restrict withdrawals to credit cards or payment apps. A step further, ‘fully-banked exchanges’ allow users to fund accounts through bank transfers and withdraw local currency directly. Understanding these distinctions aids users in selecting exchanges aligning with their banking preferences and needs.

What are makers and takers?

In the realm of Bitcoin exchanges, market depth plays a pivotal role, determined by the number of users and the size of order books. Those who contribute to these order books by placing buy and sell orders are known as market makers. Their presence enhances market depth, facilitating the buying and selling of significant amounts of bitcoin at rates closer to the global market standard.

Conversely, takers are participants who reduce liquidity by executing orders already present on the books. When users place market orders, they act as takers. Additionally, placing a limit order can also make you a taker if your order aligns with an existing order on the books. This dynamic interaction between market makers and takers influences liquidity levels and the overall efficiency of Bitcoin exchanges.

How do centralized bitcoin exchanges make money?

In the world of centralized Bitcoin exchanges, the primary revenue stream boils down to fees. These fees encompass various aspects of transactions, including:

- Withdrawal Fees:

- Charged when users withdraw bitcoin, other cryptocurrencies, or local currencies.

- Typically applied on a per-withdrawal basis rather than as a percentage of the withdrawal amount.

- Subject to frequent changes, often without prior notice.

- Trading Fees:

- Calculated as a percentage of the trade value, varying based on whether users are market makers or takers (explained earlier).

- Makers generally pay lower fees as they contribute liquidity, while takers, who remove liquidity, often face higher charges.

- Interest/Borrowing/Liquidation Fees:

- Applicable in exchanges offering margin trading, where users borrow to amplify their positions through leverage.

- Additional fees are levied based on the borrowed amount and an interest rate determined by the overall fund supply available to all traders.

- Users may incur extra charges if their leveraged position undergoes liquidation.

Understanding the diverse fee structures employed by centralized Bitcoin exchanges provides users with insights into the financial dynamics of their transactions on these platforms.

Why do I have to verify my ID to use a centralized bitcoin exchange?

The necessity for identity verification on centralized Bitcoin exchanges stems from the legal responsibilities associated with handling customers’ bitcoin and cryptocurrencies. These exchanges fall under the purview of money transmitter laws in their registered jurisdictions, compelling them to adhere to specific regulatory measures.

To comply with these regulations and mitigate risks related to money laundering, terrorist financing, and tax evasion, centralized cryptocurrency exchanges mandate a registration process where users must verify their identity before accessing the platform. Regulators typically mandate exchanges to report customer information, including trading history, upon request.

Initial access to an exchange often involves ‘lite verification’ through email verification. However, this comes with limitations such as restricted purchase amounts, limited withdrawals, and, in some cases, no withdrawal options. Users are advised to confirm withdrawal permissions before depositing any cryptocurrency.

The subsequent level of verification usually requires users to upload nationally-issued identification, such as a passport or driver’s license. Some exchanges may request a photo of the user holding their ID next to a paper with specific details, ensuring a more rigorous verification process.

It’s important to be aware that certain exchanges may exclude users from specific nationalities altogether. Therefore, understanding the verification requirements and restrictions is crucial before engaging with a Bitcoin exchange.

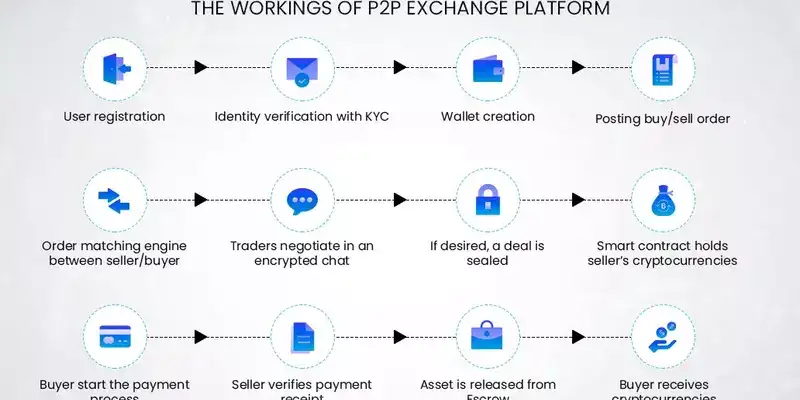

How does peer-to-peer bitcoin exchange work?

Peer-to-peer bitcoin exchanges operate through match-making platforms that serve two primary purposes: (1) connecting buyers and sellers of bitcoin and (2) facilitating trades with the use of escrow without taking custody of the traders’ bitcoin. These platforms are aptly named peer-to-peer bitcoin exchange platforms.

While peer-to-peer exchanges can be effective for buying and selling bitcoin, they come with a level of inconvenience due to the need for individual trade negotiations. Buyers may find it challenging to quickly secure the desired amount of bitcoin at competitive market rates. For sellers, legal implications vary based on jurisdiction and the volume of bitcoin involved. These factors contribute to the relatively lower liquidity of most peer-to-peer bitcoin exchange platforms compared to centralized custodial cryptocurrency exchanges.

How to Choose a Crypto Exchange

Bitcoin exchanges play the role of matchmakers, connecting buyers with sellers. Similar to traditional bank accounts, registering is typically the first step to engage in buying and selling on most crypto exchanges. After completing the Know-Your-Customer (KYC) process and authentication, your account is activated, allowing you to transfer funds—whether fiat or digital currency—onto the platform for making purchases.

Selecting the right crypto exchange is crucial, considering factors like deposit/withdrawal limits, fees, payment methods, regional restrictions and regulations, reputation, and verification requirements. Given the volatility of cryptocurrencies and the historical susceptibility of some exchanges to hacking, thorough research is essential.

Since the inception of crypto exchanges is relatively recent, it’s prudent to delve into the specifics before making a choice. The first crypto exchange, Bitcoin Market, launched on March 17, 2010. Your selection should align with your needs, budget, risk tolerance, and security expectations. Additionally, be mindful of the diverse nature of crypto exchanges—some are mobile-only, some demand powerful computers, and each varies in security levels and associated fees.

Ultimately, finding the right crypto exchange and digital assets hinges on understanding your unique requirements and navigating the dynamic landscape of cryptocurrency trading.

Conclusion Crypto Exchange

In summary, choosing a Bitcoin exchange is a crucial decision requiring consideration of factors like fees, limits, security, and reputation. Whether opting for centralized or decentralized platforms, users navigate a landscape that demands awareness of regional regulations and individual preferences. As the cryptocurrency market evolves, staying informed and adapting to changing dynamics is essential for a secure and successful trading experience.