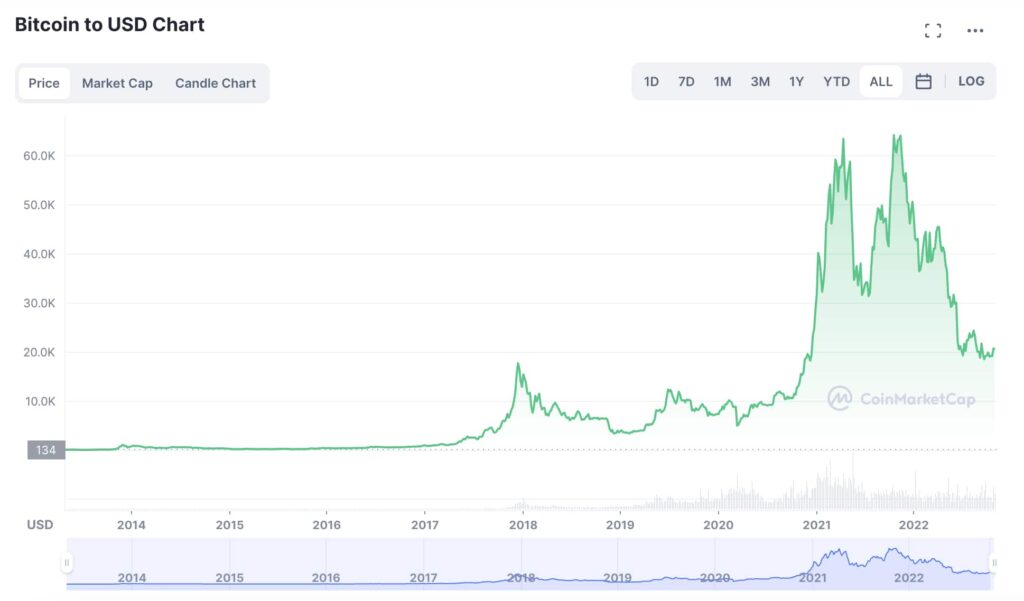

Deciding “how much to invest in cryptocurrency” is a nuanced task in the dynamic world of digital assets. Despite cryptocurrencies being the best-performing asset class since Bitcoin’s 2009 inception, the industry maintains a high-risk reputation.

In the vast cryptocurrency landscape, opportunities abound, but strategic capital allocation is crucial. This guide focuses on unraveling the optimal investment amount, striking a careful balance between potential gains and guarding against losses.

Empowering investors to make informed decisions, the guide delves into risk assessment, market trends, and personalized strategies. While cryptocurrencies showcase potential, understanding the dynamics of risk and reward is key in addressing “how much to invest in cryptocurrency.” Timing, market insights, and tailored approaches play pivotal roles in navigating this high-stakes arena.

Strategic Cryptocurrency Investment: Deciding How much to invest in cryptocurrency

When contemplating “how much to invest in cryptocurrency,” several pivotal factors come into play. Delving into the core considerations can help guide your investment decisions effectively.

Budgetary Caution:

The age-old wisdom of never investing more than one can afford to lose rings particularly true in the cryptocurrency realm. It is imperative for investors to meticulously assess their budget and determine a realistic amount that aligns with their financial comfort.

Risk Assessment:

Evaluating personal risk tolerance is a crucial step before venturing into cryptocurrency investments. While the potential gains are enticing, it’s equally important to gauge the level of risk one is comfortable taking. Cryptocurrency markets, known for significant fluctuations, demand a thoughtful consideration of potential losses.

Disposable Income Strategy:

A practical approach to assessing your investment amount involves understanding the level of disposable income available monthly. This facilitates a more risk-averse approach, enabling strategies like dollar-cost-averaging to come into play.

Long-Term Commitment:

Considering the uncertain nature of cryptocurrency markets, investors need to reflect on their capacity to endure potential waiting periods. Assessing whether you can commit to waiting months or even years for a return on your investment is crucial.

Emphasis on Quality and Innovation:

Choosing the right cryptocurrencies for investment is paramount. Focusing on high-quality, innovative projects with significant upside potential is a strategic move. Exploring new cryptocurrency projects, especially those with promising presale campaigns like the Bitcoin ETF Token, can offer substantial rewards and potential upside.

How to Decide How Much to Invest in Crypto

In the realm of cryptocurrency investment, recognizing the individuality of investors is paramount. Diverse long-term financial goals, risk tolerances, and budgets underscore the need for a personalized strategy.

When contemplating “How much to invest in cryptocurrency,” a strategic exploration awaits in the following sections, offering insights into navigating the crypto landscape in 2024.

1. Look for Low-Risk, High-Upside Crypto Projects:

Regardless of budget constraints, astute investors often gravitate towards projects with a low-risk, high-upside potential. This approach allows investors to target attractive gains without exposing themselves to significant capital risks. Notably, cryptocurrencies with a modest market capitalization often take center stage in this strategy.

Low-cap cryptocurrencies have historically demonstrated a propensity for above-average gains, as witnessed during the bull run that commenced in 2020. Pioneering projects like Shiba Inu, Decentraland, and Axie Infinity generated remarkable gains exceeding 100x.

While these projects may have already made headlines, identifying the next cryptocurrency poised for explosive growth remains an achievable endeavor. Experienced investors often turn their attention to crypto presales and Initial Coin Offerings (ICOs). The most promising upcoming ICOs empower investors to acquire newly minted tokens at the lowest possible prices.

2. The Dynamics of Crypto Presales and ICOs:

Investors participating in presales and ICOs are essentially early believers in a project. The premise is simple – by investing during this early stage, participants benefit when the token eventually gets listed on a crypto exchange at a higher price. This immediate upside serves as a reward for early support.

Currently, one presale holds particular promise as a potential standout among the best future cryptocurrency projects of 2023 and beyond. Vigilance in monitoring such opportunities is crucial for investors seeking to stay ahead in the dynamic world of cryptocurrency.

Embark on a personalized cryptocurrency investment journey by delving into these strategic considerations. The cryptocurrency landscape in 2023 offers a myriad of possibilities, and our exploration aims to equip investors with the knowledge to navigate this ever-evolving market effectively.

Table: Historical Performance of Low-Cap Cryptocurrencies

| Cryptocurrency | Bull Run (2020) Gain |

| Shiba Inu | 100x and more |

| Decentraland | 100x and more |

| Axie Infinity | 100x and more |

Investors are encouraged to conduct thorough research and due diligence before participating in any cryptocurrency investments.

Assessing the Investment Budget:

When delving into the decision of how much to invest in crypto, the investor’s budget takes center stage. This is a crucial consideration, emphasizing the need to gauge the realistic affordability of the investment. Cryptocurrencies, known for their high-risk nature, pose the potential for significant losses, as exemplified by the rapid decline of Terra Luna from a multi-billion dollar project to a valueless cryptocurrency within days. It’s essential for investors to contemplate a safety net, factoring in day-to-day living expenses and potential emergencies requiring swift access to funds.

Disposable Income for a DCA Strategy:

Steering away from attempting to time the market, a prudent strategy involves adopting Dollar-Cost Averaging (DCA). This method entails consistently investing a predetermined amount each month into the cryptocurrency markets. To determine the optimal investment amount for this strategy, investors should realistically assess what they can set aside each month. Rather than tapping into savings, this approach involves allocating funds left over after monthly expenses. Furthermore, DCA allows the investor to average out the cost price of each cryptocurrency purchase, presenting a more risk-averse strategy in the long run.

In adopting this approach, investors enhance their ability to navigate the market’s volatility, fostering disciplined and steady investment habits. This measured strategy aligns with the dynamic nature of the cryptocurrency landscape.

Building a Diversified Portfolio:

A critical aspect in the evaluation of investment quantum is the diversification of the portfolio. This not only fortifies an investor against potential losses, as witnessed in the Terra Luna case, but also offers a shield against overexposure. Investors holding a variety of cryptocurrencies alongside Terra Luna would likely have mitigated the impact of its decline. Diversification provides an opportunity for other cryptocurrencies in the portfolio to perform well, countering potential losses. Even for budget-conscious investors, diversifying is achievable as cryptocurrencies can be acquired in smaller units, requiring only a modest allocation of funds to each purchase. Platforms like eToro facilitate this with a minimum investment per trade as low as $10, providing accessibility to a multitude of altcoins.

Strategic Time Investment:

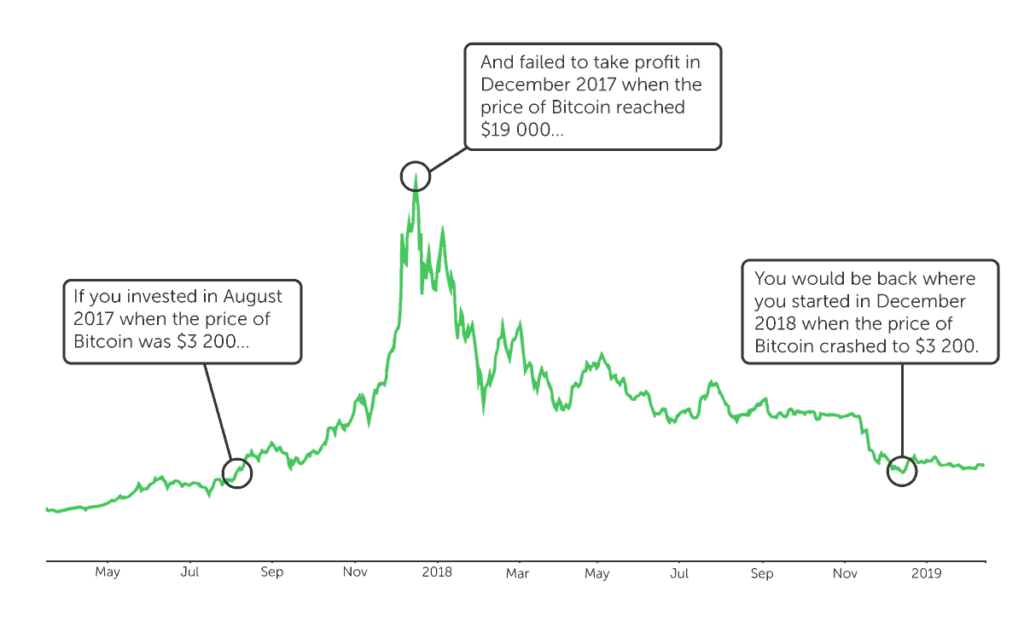

Another crucial consideration in determining how much to invest in cryptocurrency is the temporal aspect – the length of time one intends to spend in the market. The disappointment of 2022, marked by significant lows in cryptocurrency projects, prompts reflection on the waiting period for the next bullish trend. Investors must assess their willingness to ‘HODL’ (Hold On for Dear Life) and determine the time horizon for their investments. Those comfortable with waiting for extended periods should allocate funds they won’t need anytime soon. The most triumphant investors in the cryptocurrency market are often those committed to a buy-and-hold strategy in the long run. Succumbing to panic selling is discouraged, emphasizing the importance of avoiding the allocation of capital needed for immediate access.

Optimizing Crypto Investments: Liquidity

When contemplating how much to invest in cryptocurrency, gauging liquidity stands out as a critical factor. The cryptocurrency market boasts a staggering overall capitalization of $1 trillion, with a robust $72 billion in daily trading volume over the past 24 hours.

Yet, navigating smaller-cap projects introduces liquidity challenges, as many operate with meager daily trading volumes in the thousands. This scarcity complicates selling during cash-out attempts. To navigate this, savvy investors allocate only a fraction of their portfolio to smaller-cap projects, directing the majority to assets with substantial daily trading volumes.

Strategic Maneuvers in Bear Markets

While some investors shy away during bearish cycles, experienced traders argue for active participation. This contrarian approach gains credence as numerous cryptocurrencies trade at 70-90% below their bull market highs.

For budget-conscious individuals questioning how much to invest in crypto, seizing opportunities during market downturns becomes enticing. Consider an investor allocating $2,000 to MANA tokens. If executed during peak pricing in late 2021 at $5.90 per token, they would have acquired 338 MANA tokens. However, at current prices, the same investment yields 2,985 MANA tokens. Investing amidst a bear market led to a remarkable 783% increase in token holdings

How Much Should I Invest in Cryptocurrency? What the Experts Say

Determining the optimal investment in cryptocurrency can be a challenging decision for many, especially with Bitcoin reigning as the largest player in the market. Seeking guidance from experts in the field can provide valuable insights into the right approach to allocating funds. In this article, we explore various perspectives, from the seasoned advice of Bitcoin millionaire Erik Finman to more traditional models and risk management strategies.

Erik Finman’s Approach: Erik Finman, a notable Bitcoin millionaire, suggests that young investors consider dedicating 10% of their salary to leading cryptocurrencies. Finman himself accumulated over 400 BTC tokens by the age of 19. While this approach may not suit everyone, it serves as a benchmark for those entering the cryptocurrency space.

Assessing Disposable Income:

For a more risk-averse metric, it’s essential to assess disposable income. The one-size-fits-all approach may not be suitable for everyone, so understanding individual financial circumstances is crucial. This ensures a more tailored and sustainable investment strategy.

The 50-30-20 Rule:

Traditional models propose the 50-30-20 rule, allocating 30% and 50% for day-to-day necessities and discretionary spending, respectively. The remaining 20% is earmarked for investments. However, caution is advised against investing the entire 20% solely in cryptocurrency to avoid over-exposure to market cycles.

Diversification Across Asset Classes:

Diversification is key to a well-rounded investment portfolio. While cryptocurrencies hold potential, it’s wise to consider other asset classes, including property, stocks, index funds, and bonds. This diversified approach helps mitigate risks associated with the volatile nature of cryptocurrency markets.

Risk Management:

Even strong proponents of cryptocurrencies emphasize the importance of only investing money one is prepared to lose. This risk management approach safeguards investors from potential losses while allowing them to participate in the market’s potential gains.

Allocating a Tiny Percentage:

The good news is that allocating a small percentage of an investment portfolio to cryptocurrency can still yield significant results over the long run. Despite the ongoing crypto winter, projects like Tamadoge and Lucky Block have witnessed impressive post-presale gains, proving the potential for substantial returns even with a modest investment.

Strategizing Your Crypto Portfolio for Success

Are you pondering the right crypto portfolio allocation? Crafting a successful investment mix involves diversification across cryptocurrencies and other assets. Recognizing the uniqueness of each investor, a universal rule on how much to invest in cryptocurrency is impractical.

Consider factors such as risk tolerance, belief in crypto, financial goals, and time commitment. Age is a crucial determinant: young investors may explore growth stocks and emerging bonds, while those nearing retirement prioritize stability with blue-chip stocks and US treasuries.

A slow, steady entry into crypto is wise, limiting exposure to 5% of the portfolio and diversifying the rest. This ensures minimal impact if crypto investments don’t go as planned. Even allocating just 5% to crypto can yield impressive returns during the next bull market.

Crafting a winning crypto portfolio involves tailoring strategies to individual preferences, emphasizing a personalized and flexible approach for long-term success.

Mastering Crypto Investment: A Pragmatic Approach

Navigating the world of cryptocurrency investments raises the inevitable question: How much money should I invest in crypto? The answer, however, is not a straightforward one.

Similar to any investment endeavor, the decision hinges on your financial goals, timing preferences, and risk tolerance. To gauge these factors effectively, introspect on questions such as:

- Comfortable Investment: How much money are you at ease with investing?

- Risk Appetite: How much money are you comfortable losing?

- Market Volatility: Do you have the resilience to witness crypto markets fluctuate, sometimes by as much as 30% in a day?

Owning cryptocurrency introduces an enticing avenue for portfolio diversification, opening doors to a potentially lucrative future market. Yet, the cost can be significant. For instance, Bitcoin is valued at around AU$50,000+, while Ethereum hovers around AU$4,000.

While there are more affordable cryptocurrencies, their trajectory depends on your upfront investment. Time-honored advice cautions against investing more than you can afford to lose—a prudent approach, especially given the unpredictability of the crypto landscape.

Considering the relative infancy of the crypto market, predicting its ultimate trajectory remains uncertain. Instead of fixating on “how much,” let’s delve into “how to invest in cryptocurrency.“

Determining a suitable allocation across your investments involves assessing your knowledge about the product. Cryptocurrency remains somewhat enigmatic for many, requiring diligent research and market tracking to justify a larger capital investment.

Conventional wisdom suggests a safe allocation of 1% to 5% for higher-risk investments like crypto. Given its inherent volatility, crypto carries a level of risk that should align with your risk appetite.

While 1% to 5% might seem modest, it possesses the potential to grow significantly over time. Imagine the possibilities if you had allocated just 3% into Bitcoin during its inception. This modest percentage allows you to test your risk appetite while not overshadowing the value of other investments should the crypto market take an unexpected turn.

Conclusion – How much to invest in cryptocurrency

When delving into crypto investments, taking a gradual approach is key. Figuring out how much to invest in cryptocurrency requires thoughtful consideration of your comfort level with investment amounts and your tolerance for market volatility.

Starting with a conservative crypto allocation, even as minimal as 1% of your portfolio, opens doors to unique opportunities not often found in traditional investments. It’s a smart entry point to understand the crypto market dynamics and potential advantages.

FAQs

Is investing in crypto worth it?

Exploring cryptocurrency investment raises the question: Is it worthwhile? Dating back to Bitcoin’s 2009 launch, cryptocurrencies shine as top performers despite their volatility. In 2022, many have seen gains surpassing tenfold. Yet, caution is key—potential returns should align with what investors can afford to risk, considering the unpredictable nature of the crypto landscape. In essence, the allure of cryptocurrency investment lies in balancing promising gains with prudent risk management, tailored to individual risk tolerance.

Can you get rich investing in crypto?

Unlocking wealth in cryptocurrency requires strategic early investments. Despite missing the historic returns of Bitcoin and Ethereum, new opportunities emerge in 2024 through presale campaigns. These initiatives offer a chance for investors to engage in projects from the start, potentially reaping significant rewards as projects mature. Adaptability is crucial in this evolving market, encouraging new investors to explore presale campaigns strategically for potential wealth accumulation. Understanding each project’s intricacies is key, as adaptability and strategic acumen are essential in navigating the changing landscape of cryptocurrency investments.

Is it worth investing $100 in crypto?

Cryptocurrency investments are about personalized risk management, not a set minimum. Reflecting on the surge of a $100 investment in BNB to over $600,000 in 2021 highlights potential gains but doesn’t guarantee future success. To navigate this volatile market, align your investment with your risk tolerance, diversify strategically, and stay adaptable for long-term growth.

Read more: https://investorrights.law.miami.edu/how-are-cryptocurrencies-being-regulated/